Does Navitas Limited’s (ASX:NVT) Debt Level Pose A Serious Problem?

Navitas Limited (ASX:NVT) is a small-cap stock with a market capitalization of AUD $1.71B. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? A major downturn in the energy industry has resulted in over 150 companies going bankrupt and has put more than 100 on the verge of a collapse, primarily due to excessive debt. Thus, it becomes utmost important for an investor to test a company’s resilience for such contingencies. In simple terms, I believe these three small calculations tell most of the story you need to know. See our latest analysis for NVT

Does NVT generate enough cash through operations?

There are many headwinds that come unannounced, such as natural disasters and political turmoil, which can challenge a small business and its ability to adapt and recover. These catastrophes does not mean the company can stop servicing its debt obligations. Fortunately, we can test the company’s capacity to pay back its debtholders without summoning any catastrophes by looking at how much cash it generates from its current operations. NVT’s recent operating cash flow was 0.37 times its debt within the past year. A ratio of over a 0.25x is a positive sign and shows that NVT is generating ample cash from its core business, which should increase its potential to pay back near-term debt.

Does NVT’s liquid assets cover its short-term commitments?

In addition to debtholders, a company must be able to pay its bills and salaries to keep the business running. During times of unfavourable events, NVT could be required to liquidate some of its assets to meet these upcoming payments, as cash flow from operations is hindered. We should examine if the company’s cash and short-term investment levels match its current liabilities. Our analysis shows that NVT is unable to meet all of its upcoming commitments with its cash and other short-term assets. While this is not abnormal for companies, as their cash is better invested in the business or returned to investors than lying around, it does bring about some concerns should any unfavourable circumstances arise.

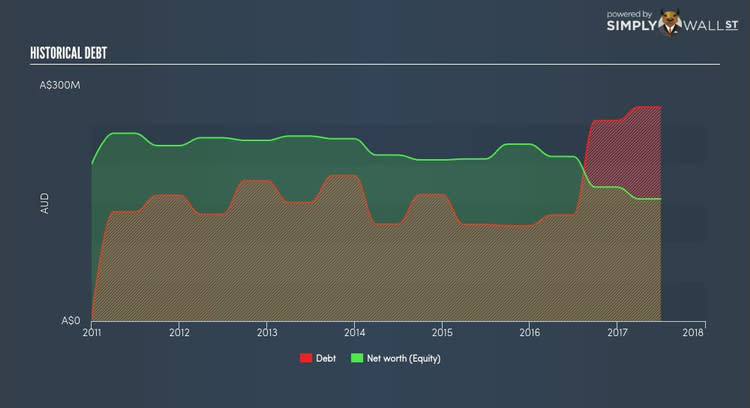

Is NVT’s level of debt at an acceptable level?

Debt-to-equity ratio tells us how much of the asset debtors could claim if the company went out of business. In the case of NVT, the debt-to-equity ratio is over 100%, which indicates that the company is holding a high level of debt relative to its net worth. In the event of financial turmoil, the company may experience difficulty meeting interest and other debt obligations. No matter how high the company’s debt, if it can easily cover the interest payments, it’s considered to be efficient with its use of excess leverage. A company generating earnings at least three times its interest payments is considered financially sound. In NVT’s case, its interest is excessively covered by its earnings as the ratio sits at 16.59x. Lenders may be less hesitant to lend out more funding as NVT’s high interest coverage is seen as responsible and safe practice.

Next Steps:

Are you a shareholder? Although NVT’s debt level is towards the higher end of the spectrum, its cash flow coverage seems adequate to meet obligations which means its debt is being efficiently utilised. But, its low liquidity raises concerns over whether short term obligations can be met in time, and increasing debt funding to meet these needs could prove difficult. Going forward, NVT’s financial situation may change. I suggest researching market expectations for NVT’s future growth on our free analysis platform.

Are you a potential investor? Investors shouldn’t be put off by NVT’s high debt levels based on this simple analysis. High level of cash generated from operating activities indicates its debt funding is being effectively used. Though, the company may not be able to pay all of its upcoming liabilities from its current short-term assets. To gain more conviction in the stock, you need to also analyse the company’s track record. You should continue your analysis by taking a look at NVT’s past performance analysis on our free platform to figure out NVT’s financial health position.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.