Does Nu Skin Enterprises (NYSE:NUS) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Nu Skin Enterprises (NYSE:NUS). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Nu Skin Enterprises

How Fast Is Nu Skin Enterprises Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Nu Skin Enterprises managed to grow EPS by 14% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

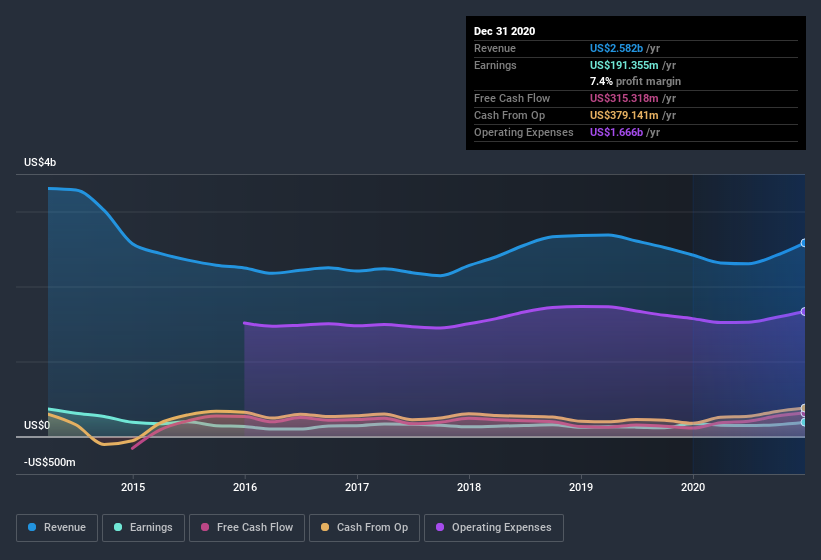

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Nu Skin Enterprises's EBIT margins were flat over the last year, revenue grew by a solid 6.7% to US$2.6b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Nu Skin Enterprises's future profits.

Are Nu Skin Enterprises Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite -US$2.0m worth of sales, Nu Skin Enterprises insiders have overwhelmingly been buying the stock, spending US$2.2m on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Executive Chairman of the Board, Steven Lund, who made the biggest single acquisition, paying US$1.0m for shares at about US$48.05 each.

Along with the insider buying, another encouraging sign for Nu Skin Enterprises is that insiders, as a group, have a considerable shareholding. With a whopping US$54m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Should You Add Nu Skin Enterprises To Your Watchlist?

One important encouraging feature of Nu Skin Enterprises is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. If you think Nu Skin Enterprises might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Nu Skin Enterprises, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.