Does Parsons' (NYSE:PSN) Share Price Gain of 12% Match Its Business Performance?

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. For example, the Parsons Corporation (NYSE:PSN), share price is up over the last year, but its gain of 12% trails the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Parsons

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Parsons actually shrank its EPS by 26%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Unfortunately Parsons' fell 4.9% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

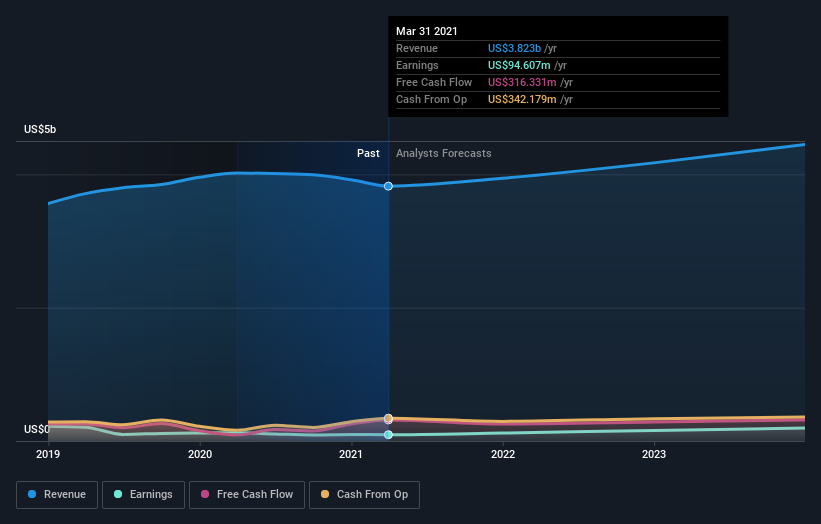

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Parsons will earn in the future (free profit forecasts).

A Different Perspective

We're happy to report that Parsons are up 12% over the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 38%. The last three months haven't been great for shareholder returns, since the share price has trailed the market by 12% in the last three months. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.