Does Preformed Line Products (NASDAQ:PLPC) Deserve A Spot On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Preformed Line Products (NASDAQ:PLPC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Preformed Line Products

How Fast Is Preformed Line Products Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, Preformed Line Products has grown EPS by 36% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

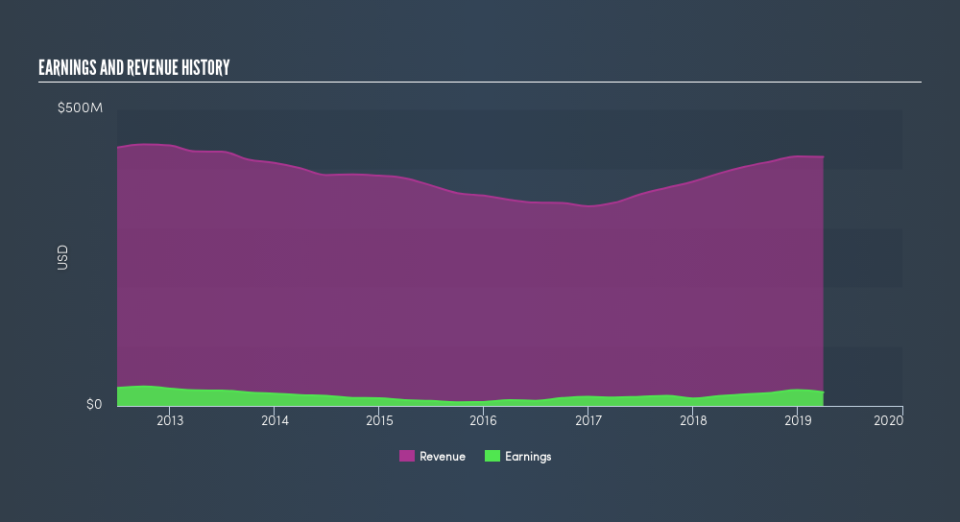

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Preformed Line Products maintained stable EBIT margins over the last year, all while growing revenue 7.2% to US$420m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Preformed Line Products is no giant, with a market capitalization of US$247m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Preformed Line Products Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Preformed Line Products insiders own a significant number of shares certainly appeals to me. In fact, they own 47% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about US$115m riding on the stock, at current prices. That's nothing to sneeze at!

Does Preformed Line Products Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Preformed Line Products's strong EPS growth. Further, the high level of insider buying impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Now, you could try to make up your mind on Preformed Line Products by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although Preformed Line Products certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.