How Does Quantum Corporation (NYSE:QTM) Affect Your Portfolio Returns?

If you are looking to invest in Quantum Corporation’s (NYSE:QTM), or currently own the stock, then you need to understand its beta in order to understand how it can affect the risk of your portfolio. The beta measures QTM’s exposure to the wider market risk, which reflects changes in economic and political factors. Not all stocks are expose to the same level of market risk, and the broad market index represents a beta value of one. A stock with a beta greater than one is considered more sensitive to market-wide shocks compared to a stock that trades below the value of one.

See our latest analysis for Quantum

An interpretation of QTM’s beta

With a beta of 2.19, Quantum is a stock that tends to experience more gains than the market during a growth phase and also a bigger reduction in value compared to the market during a broad downturn. According to this value of beta, QTM can help magnify your portfolio return, especially if it is predominantly made up of low-beta stocks. If the market is going up, a higher exposure to the upside from a high-beta stock can push up your portfolio return.

Does QTM’s size and industry impact the expected beta?

With a market cap of USD $218.10M, QTM falls within the small-cap spectrum of stocks, which are found to experience higher relative risk compared to larger companies. In addition to size, QTM also operates in the tech industry, which has commonly demonstrated strong reactions to market-wide shocks. So, investors should expect a larger beta for smaller companies operating in a cyclical industry in contrast with lower beta for larger firms in a more defensive industry. This supports our interpretation of QTM’s beta value discussed above. Next, we will examine the fundamental factors which can cause cyclicality in the stock.

How QTM’s assets could affect its beta

An asset-heavy company tends to have a higher beta because the risk associated with running fixed assets during a downturn is highly expensive. I examine QTM’s ratio of fixed assets to total assets to see whether the company is highly exposed to the risk of this type of constraint. Since QTM’s fixed assets are only 28.31% of its total assets, it doesn’t depend heavily on a high level of these rigid and costly assets to operate its business. Thus, we can expect QTM to be more stable in the face of market movements, relative to its peers of similar size but with a higher portion of fixed assets on their books. This outcome contradicts QTM’s current beta value which indicates an above-average volatility.

What this means for you:

You could benefit from higher returns during times of economic growth by holding onto QTM. Its low fixed cost also means that, in terms of operating leverage, it is relatively flexible during times of economic downturns. In order to fully understand whether QTM is a good investment for you, we also need to consider important company-specific fundamentals such as Quantum’s financial health and performance track record. I highly recommend you to complete your research by taking a look at the following:

1. Financial Health: Is QTM’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

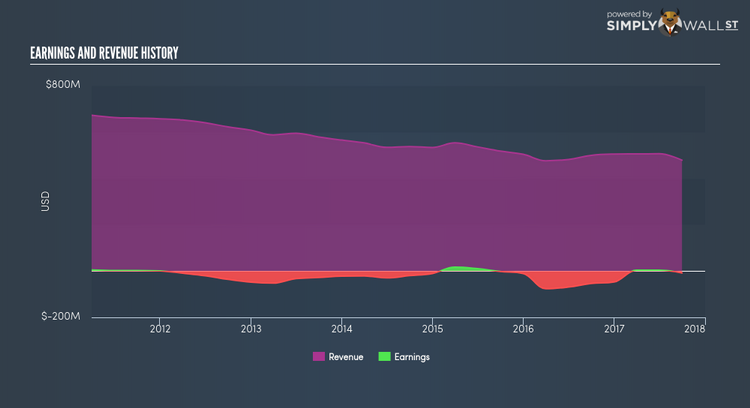

2. Past Track Record: Has QTM been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of QTM’s historicals for more clarity.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.