What Does RPC's (RES) Q4 Earnings Beat Mean for Its Industry?

RPC Inc. RES reported strong fourth-quarter 2021 results, owing to higher activity levels in all the service lines and improved pricing. This is encouraging for the oilfield service providers as the industry upcycling is creating a favorable space for the companies.

In the last few quarters, oilfield service providers incurred massive losses, courtesy of decreased upstream activities. However, the favorable commodity pricing scenario encouraged customers to continue drilling and completion activities, which might keep the demand for oilfield services high. As such, pricing improvements witnessed by RPC in the fourth quarter can be viewed as a major positive indicator for the upcoming quarters.

Q4 Results

RPC reported adjusted earnings of 6 cents per share for the fourth quarter, beating the Zacks Consensus Estimate of 3 cents. The bottom line compares favorably with the year-ago loss of 3 cents.

Total quarterly revenues of $268.3 million outpaced the Zacks Consensus Estimate of $241 million. The top line also significantly improved from the year-ago figure of $148.6 million.

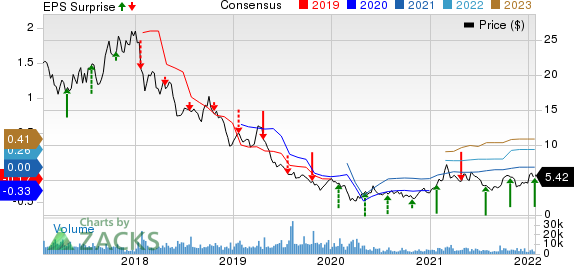

RPC, Inc. Price, Consensus and EPS Surprise

RPC, Inc. price-consensus-eps-surprise-chart | RPC, Inc. Quote

Segmental Performance

Operating profit in the Technical Services segment totaled $20.5 million against a loss of $11.3 million in the year-ago quarter. The improvement can be attributed to higher activity levels in most service lines and improved pricing.

Operating loss in the Support Services segment was $373,000, narrower than the unit’s operating loss of $2.6 million in the year-ago quarter. The upside was caused by increased activities.

Total operating profit for the quarter was $20.1 million, significantly improving from the year-ago loss of $21.7 million. The average domestic rig count was 561 for the December-end quarter, reflecting an 80.4% increase from the year-ago level. The average oil price for the quarter was $77.27 per barrel. The same for natural gas was $4.73 per thousand cubic feet.

Cost and Expenses

Cost of revenues increased from $118 million in fourth-quarter 2020 to $200.6 million. Selling, general and administrative expenses increased to $32.1 million from the year-ago figure of $26 million.

The increased cost of revenues was mainly due to higher expenses related to increased activity levels, fuel costs and others.

Financials

RPC’s total capital expenditure for the December-end quarter of 2021 amounted to $22.7 million.

As of Dec 31, RPC had cash and cash equivalents of $82.4 million, up sequentially from $80.8 million. Nonetheless, the company managed to maintain a debt-free balance sheet.

Outlook

For 2022, RPC expects a capital expenditure of $125 million, indicating a significant increase from $67.6 million last year.

In the fourth quarter, RPC operated eight horizontal pressure pumping fleets. The company’s new Tier IV dual-fuel pressure pumping fleet, which came online in the Permian Basin at the end of the third quarter, boosted its utilization rate and profits in the reported quarter.

Zacks Rank & Stocks to Consider

RPC currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BP plc BP, based in London, the U.K., is a fully integrated energy company, with a strong focus on renewable energy. BP has a strong portfolio of upstream projects, which has been backing impressive production growth.

BP is expected to see an earnings growth of 19% in 2022. BP announced that before declaring results for the December-end quarter, it has intended to execute an additional $1.25 billion of share repurchases. BP continues to anticipate buying back $1 billion worth of shares every quarter, considering Brent crude price at $60 per barrel. On the dividend front, BP projects a hike in the annual dividend per ordinary share of 4% through 2025.

Equinor ASA EQNR is one of the premier integrated energy companies in the world, with operations spreading across 30 countries. Over the years, EQNR has developed its expertise to expand upstream operations outside of conventional offshore resources to the prolific shale oil and gas plays.

Equinor is expected to see an earnings growth of 18.1% in 2022. EQNR currently has a Zacks Style Score of A for both Value and Growth. Equinor’s key strategy is to capitalize on the renewable energy space and align operations with the Paris Climate Agreement. Hence, it is actively investing in renewable energy projects, comprising power generation from solar and wind energy.

PetroChina Company Limited PTR is the largest integrated oil company in China. PTR is one of the largest producers of crude oil and natural gas in the world. PetroChina’s natural gas business offers lucrative growth prospects in the coming years as China moves from coal to natural gas.

PetroChinais expected to see an earnings growth of 8.5% in 2022. PTRcurrently has a Zacks Style Score of A for Value and B for Momentum. In the first nine months of 2021, PetroChina's upstream segment posted an operating income of RMB 58.4 billion, nearly tripling from the year-ago profit of RMB 20 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

PetroChina Company Limited (PTR) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research