Does SS&C Technologies Holdings (NASDAQ:SSNC) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like SS&C Technologies Holdings (NASDAQ:SSNC), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for SS&C Technologies Holdings

How Fast Is SS&C Technologies Holdings Growing Its Earnings Per Share?

In the last three years SS&C Technologies Holdings's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. SS&C Technologies Holdings boosted its trailing twelve month EPS from US$2.73 to US$3.13, in the last year. I doubt many would complain about that 15% gain.

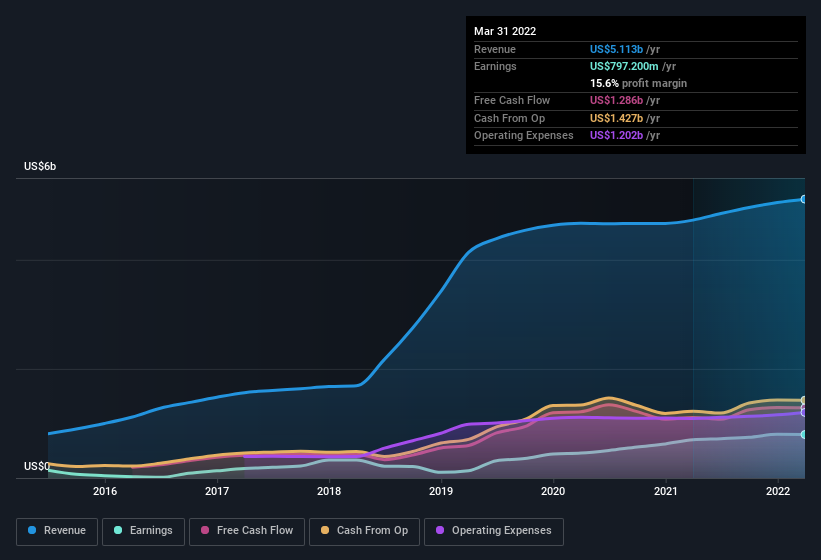

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note SS&C Technologies Holdings's EBIT margins were flat over the last year, revenue grew by a solid 8.1% to US$5.1b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of SS&C Technologies Holdings's forecast profits?

Are SS&C Technologies Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One positive for SS&C Technologies Holdings, is that company insiders paid US$33k for shares in the last year. While this isn't much, we also note an absence of sales.

On top of the insider buying, it's good to see that SS&C Technologies Holdings insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$2.0b. That equates to 13% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Does SS&C Technologies Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of SS&C Technologies Holdings is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. We should say that we've discovered 2 warning signs for SS&C Technologies Holdings (1 is a bit concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of SS&C Technologies Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.