Does Story-I (ASX:SRY) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Story-I Limited (ASX:SRY) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Story-I

How Much Debt Does Story-I Carry?

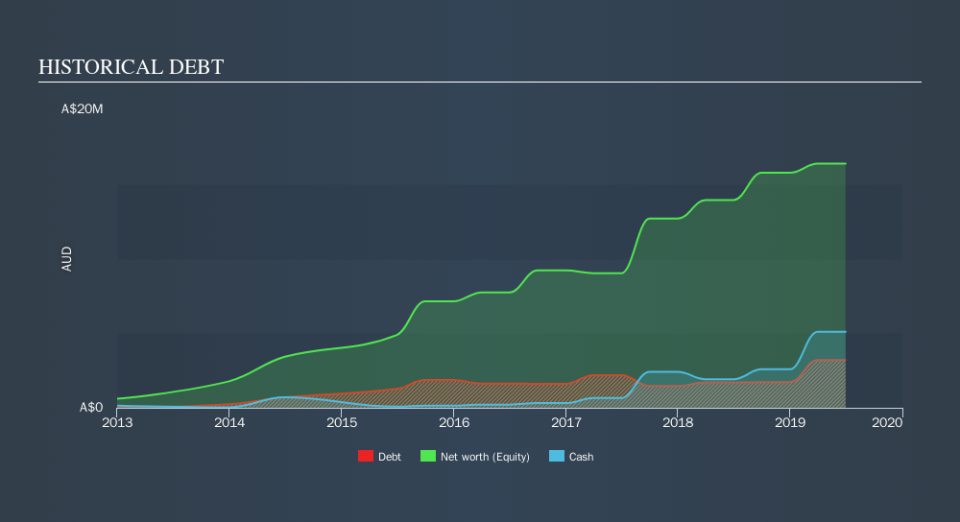

The image below, which you can click on for greater detail, shows that at June 2019 Story-I had debt of AU$3.19m, up from AU$1.71m in one year. However, it does have AU$5.10m in cash offsetting this, leading to net cash of AU$1.91m.

A Look At Story-I's Liabilities

According to the last reported balance sheet, Story-I had liabilities of AU$18.7m due within 12 months, and liabilities of AU$1.63m due beyond 12 months. On the other hand, it had cash of AU$5.10m and AU$7.81m worth of receivables due within a year. So it has liabilities totalling AU$7.41m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the AU$4.46m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt After all, Story-I would likely require a major re-capitalisation if it had to pay its creditors today. Given that Story-I has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Shareholders should be aware that Story-I's EBIT was down 40% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But it is Story-I's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Story-I has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Story-I's free cash flow amounted to 27% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While Story-I does have more liabilities than liquid assets, it also has net cash of AU$1.91m. Unfortunately, though, both its struggle level of total liabilities and its EBIT growth rate leave us concerned about Story-I So despite the cash, we do think it carries some risks. Over time, share prices tend to follow earnings per share, so if you're interested in Story-I, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.