Does TransGlobe Energy Corporation (NASDAQ:TGA) Have A Place In Your Dividend Stock Portfolio?

Dividend paying stocks like TransGlobe Energy Corporation (NASDAQ:TGA) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if TransGlobe Energy is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . Some simple analysis can reduce the risk of holding TransGlobe Energy for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on TransGlobe Energy!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. TransGlobe Energy paid out 15% of its profit as dividends, over the trailing twelve month period. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Last year, TransGlobe Energy paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Remember, you can always get a snapshot of TransGlobe Energy's latest financial position, by checking our visualisation of its financial health.

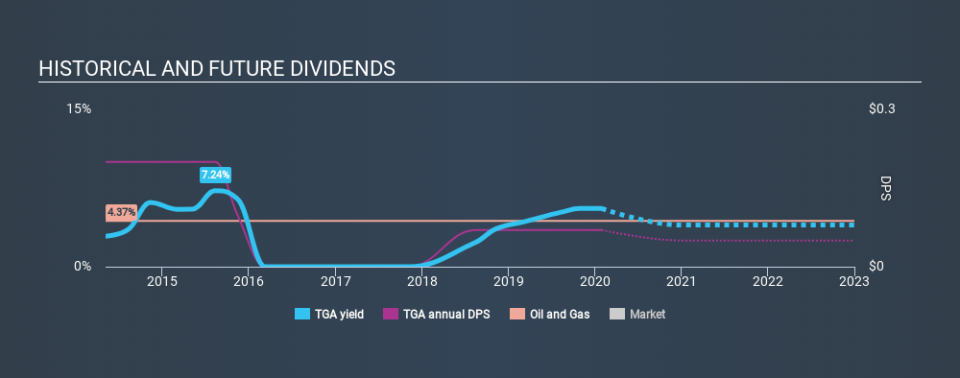

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. TransGlobe Energy has been paying a dividend for the past six years. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past six-year period, the first annual payment was US$0.20 in 2014, compared to US$0.07 last year. Dividend payments have fallen sharply, down 65% over that time.

We struggle to make a case for buying TransGlobe Energy for its dividend, given that payments have shrunk over the past six years.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. In the last five years, TransGlobe Energy's earnings per share have shrunk at approximately 9.4% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, the company has a conservative payout ratio, although we'd note that its cashflow in the past year was substantially lower than its reported profit. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Overall, TransGlobe Energy falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

Are management backing themselves to deliver performance? Check their shareholdings in TransGlobe Energy in our latest insider ownership analysis.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.