Does Vertex Pharmaceuticals (NASDAQ:VRTX) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Vertex Pharmaceuticals (NASDAQ:VRTX), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Vertex Pharmaceuticals

Vertex Pharmaceuticals's Improving Profits

Over the last three years, Vertex Pharmaceuticals has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Vertex Pharmaceuticals's EPS shot from US$5.86 to US$10.63, over the last year. Year on year growth of 81% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

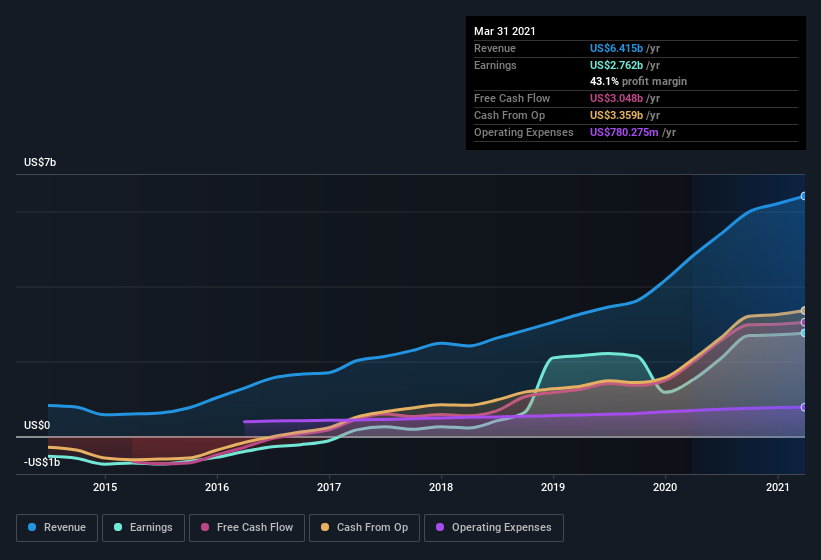

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Vertex Pharmaceuticals is growing revenues, and EBIT margins improved by 13.1 percentage points to 47%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Vertex Pharmaceuticals's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Vertex Pharmaceuticals Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Vertex Pharmaceuticals, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, the Lead Independent Director, Bruce Sachs, accumulated US$3.3m worth of shares around US$217. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for Vertex Pharmaceuticals is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at US$69m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Reshma Kewalramani is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Vertex Pharmaceuticals, with market caps over US$8.0b, is about US$11m.

The Vertex Pharmaceuticals CEO received US$9.1m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Vertex Pharmaceuticals Worth Keeping An Eye On?

Vertex Pharmaceuticals's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Vertex Pharmaceuticals deserves timely attention. Now, you could try to make up your mind on Vertex Pharmaceuticals by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But Vertex Pharmaceuticals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.