What Does VMware's (NYSE:VMW) CEO Pay Reveal?

Pat Gelsinger became the CEO of VMware, Inc. (NYSE:VMW) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for VMware

How Does Total Compensation For Pat Gelsinger Compare With Other Companies In The Industry?

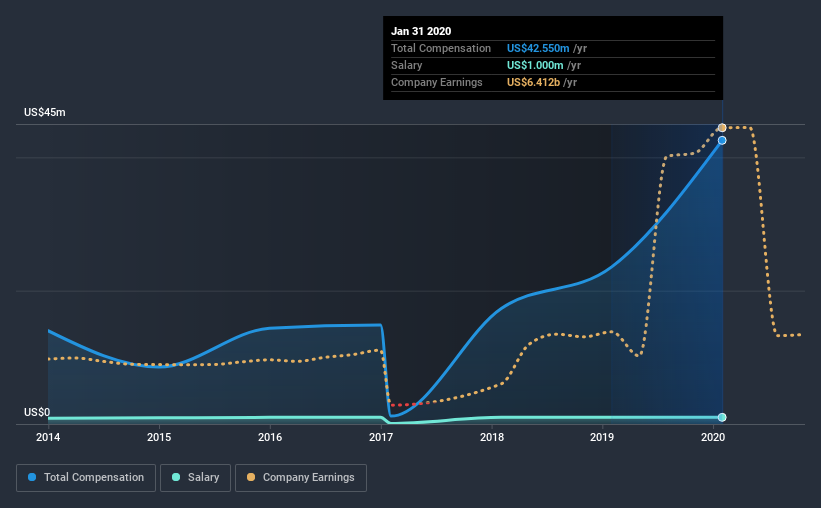

Our data indicates that VMware, Inc. has a market capitalization of US$60b, and total annual CEO compensation was reported as US$43m for the year to January 2020. We note that's an increase of 81% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.0m.

In comparison with other companies in the industry with market capitalizations over US$8.0b , the reported median total CEO compensation was US$9.6m. This suggests that Pat Gelsinger is paid more than the median for the industry. Furthermore, Pat Gelsinger directly owns US$88m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$1.0m | US$1.0m | 2% |

Other | US$42m | US$23m | 98% |

Total Compensation | US$43m | US$24m | 100% |

On an industry level, around 13% of total compensation represents salary and 87% is other remuneration. Investors may find it interesting that VMware paid a marginal salary to Pat Gelsinger, over the past year, focusing on non-salary compensation instead. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

VMware, Inc.'s Growth

VMware, Inc. has seen its earnings per share (EPS) increase by 53% a year over the past three years. Its revenue is up 5.3% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has VMware, Inc. Been A Good Investment?

We think that the total shareholder return of 36%, over three years, would leave most VMware, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

VMware prefers rewarding its CEO through non-salary benefits. As we touched on above, VMware, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, VMware has produced strong EPS growth and shareholder returns over the last three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. Given the strong history of shareholder returns, the shareholders are probably very happy with Pat's performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for VMware that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.