Does Walkabout Resources Limited’s (ASX:WKT) Past Performance Indicate A Stronger Future?

Measuring Walkabout Resources Limited’s (ASX:WKT) track record of past performance is a valuable exercise for investors. It allows us to understand whether or not the company has met or exceed expectations, which is an insightful signal for future performance. Today I will assess WKT’s recent performance announced on 31 December 2017 and compare these figures to its historical trend and industry movements. View our latest analysis for Walkabout Resources

How Did WKT’s Recent Performance Stack Up Against Its Past?

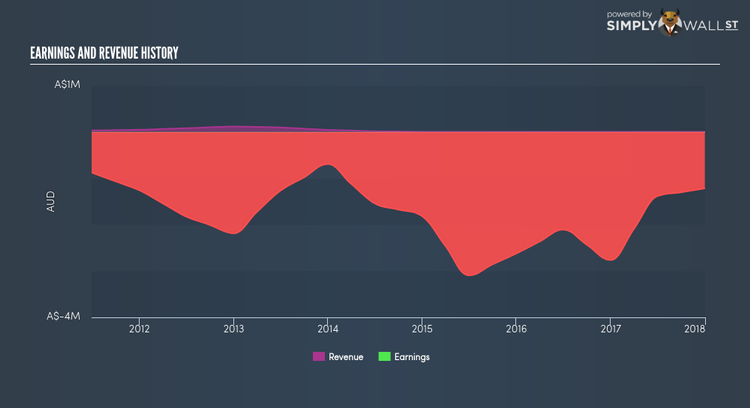

For the most up-to-date info, I use data from the most recent 12 months, which annualizes the latest 6-month earnings release, or some times, the latest annual report is already the most recent financial data. This blend enables me to analyze different stocks in a uniform manner using the most relevant data points. For Walkabout Resources, its latest trailing-twelve-month earnings is -AU$1.22M, which, against last year’s level, has become less negative. Since these figures may be relatively short-term thinking, I have computed an annualized five-year value for WKT’s net income, which stands at -AU$1.79M. This means while net income is negative, it has become less negative over the years.

We can further assess Walkabout Resources’s loss by looking at what the industry has been experiencing over the past few years. Each year, for the last five years Walkabout Resources has seen an annual decline in revenue of -40.74%, on average. This adverse movement is a driver of the company’s inability to reach breakeven. Has the entire industry experienced this headwind? Viewing growth from a sector-level, the Australian metals and mining industry has been growing its average earnings by double-digit 15.45% over the previous year, and 13.22% over the past half a decade. This means that, even though Walkabout Resources is presently loss-making, it may have gained from industry tailwinds, moving earnings in the right direction.

What does this mean?

Though Walkabout Resources’s past data is helpful, it is only one aspect of my investment thesis. With companies that are currently loss-making, it is always difficult to envisage what will occur going forward, and when. The most useful step is to examine company-specific issues Walkabout Resources may be facing and whether management guidance has dependably been met in the past. You should continue to research Walkabout Resources to get a better picture of the stock by looking at:

1. Financial Health: Is WKT’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

2. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 December 2017. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.