Does White Mountains Insurance Group (NYSE:WTM) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like White Mountains Insurance Group (NYSE:WTM). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for White Mountains Insurance Group

White Mountains Insurance Group's Improving Profits

In the last three years White Mountains Insurance Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, White Mountains Insurance Group's EPS soared from US$68.11 to US$89.68, in just one year. That's a commendable gain of 32%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of White Mountains Insurance Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that White Mountains Insurance Group is growing revenues, and EBIT margins improved by 13.3 percentage points to 44%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

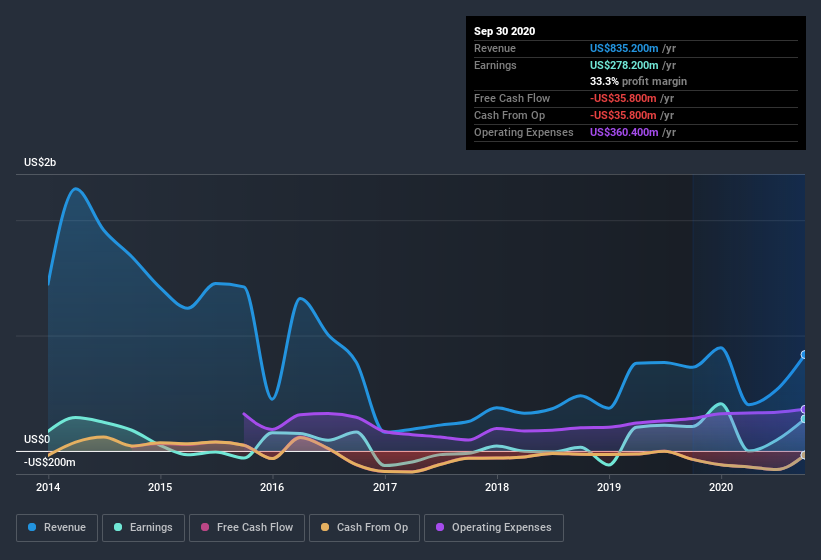

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are White Mountains Insurance Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insider selling of White Mountains Insurance Group shares was insignificant compared to the one buyer, over the last twelve months. Specifically the Independent Non-Executive Chairman, Morgan Davis, spent US$795k, paying about US$758 per share. That certainly pricks my ears up.

Along with the insider buying, another encouraging sign for White Mountains Insurance Group is that insiders, as a group, have a considerable shareholding. With a whopping US$77m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Should You Add White Mountains Insurance Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about White Mountains Insurance Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if White Mountains Insurance Group is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of White Mountains Insurance Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.