Dollar General (DG) Lags Q3 Earnings Estimate, Cuts FY22 View

Dollar General Corporation DG came up with third-quarter fiscal 2022 results, with the top and the bottom line increasing year over year. Earnings missed the Zacks Consensus Estimate while sales beat the same.

The company saw a modest rise in customer traffic and continued share gains in consumable and non-consumable product sales. That said, cost pressures and supply chain-related issues leading to greater-than-expected distribution and transportation costs were hurdles.

Taking into account higher-than-expected gross margin pressures, sales mix, inventory shrink and damages, management is lowering its earnings per share (EPS) guidance for fiscal 2022. The company is narrowing its expectations for same-store sales growth guidance for fiscal 2022.

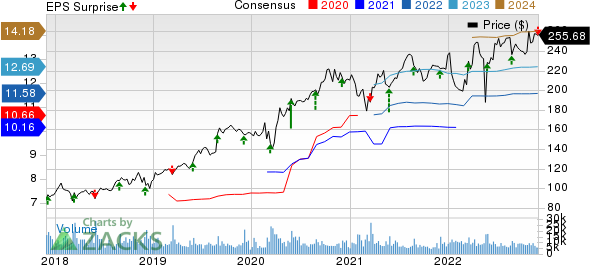

Dollar General Corporation Price, Consensus and EPS Surprise

Dollar General Corporation price-consensus-eps-surprise-chart | Dollar General Corporation Quote

Let’s Delve Deeper

The quarterly earnings came in at $2.33 per share, which missed the Zacks Consensus Estimate of $2.55. Nevertheless, the bottom line increased 12% from the prior-year quarter’s levels.

Net sales of $9,464.9 million rose 11.1% from the prior-year quarter’s reported figure. The upside can be attributed to positive sales contributions from new stores and gains from same-store sales. These were somewhat offset by the impact of store closures. The top line came ahead of the Zacks Consensus Estimate of $9,434.8 million.

Dollar General’s same-store sales rose 6.8% on the back of a rise in average transaction amount and modest growth in customer traffic. Same-store sales reflected growth in the consumables category, somewhat countered by a decline in the apparel, seasonal and home products categories.

Based on categories, sales increased 14.3% year over year to $7,664.8 million for Consumables. Sales rose 3.2% to $942.8 million for Seasonal and 4.2% to $574.4 million for Home Products. However, the same declined 18.8% to $282.8 million in the Apparel category.

The gross profit increased to $2,885.2 million from $2,619.4 million reported in the year-ago quarter. Gross margin contracted 27 basis points (bps) to 30.5%. The contraction in gross profit margin can be attributed to a rise in LIFO provision, a higher proportion of sales from the consumables category and higher distribution costs, markdowns, inventory shrink and damages. This was somewhat offset by increased inventory markups.

SG&A expenses, as a percentage of net sales, contracted 23 bps to 22.7% in the quarter. The operating profit jumped 10.5% to $735.5 million.

Store Update

During the quarter under discussion, Dollar General opened 268 new stores, remodeled 485 stores and relocated 45 stores. The company anticipates carrying out 2,945 real estate projects, including 1,025 new store openings, 1,795 remodels and 125 store relocations in fiscal 2022.

Other Financial Details

Dollar General ended the quarter with cash and cash equivalents of $362.7 million, long-term obligations of $5,985.7 million and shareholders’ equity of $6,093.8 million.

For fiscal 2022, the company anticipates capital expenditures of nearly $1.5 billion.

During the quarter, Dollar General repurchased 2.3 million shares for $546 million. The company had $2.5 billion remaining under the authorization at the end of the quarter. The company expects to make share repurchases of $2.75 billion in fiscal 2022.

On Nov 30, 2022, management announced a quarterly cash dividend of 55 cents per share, payable on or before Jan 17, 2023, to shareholders on record as of Jan 3, 2023.

Image Source: Zacks Investment Research

Outlook

Dollar General expects net sales growth of about 11% — including an estimated benefit of approximately two percentage points from the 53rd week — for fiscal 2022. The company now foresees same-store sales growth toward the upper end of its earlier projected range of 4-4.5% for the fiscal year 2022. The company now expects EPS growth in the range of 7- 8% for the fiscal year 2022, compared with the earlier guidance of 12-14% growth. The view includes an estimated benefit of approximately four percentage points from the 53rd week.

For the fourth quarter of fiscal 2022, the company expects same-store sales growth of 6- 7%. Management expects quarterly EPS between $3.15 and $3.30.

Shares of this Zacks Rank #2 (Buy) company have increased 13.7% in the past six months compared with the industry’s rise of 11.5%.

3 More Stocks Looking Red Hot

Here we have highlighted three other top-ranked stocks, namely Ross Stores Inc. ROST, Dillard's, Inc. DDS and Sprouts Farmers SFM.

Ross Stores, an off-price retailer of apparel and home accessories in the United States, currently carries a Zacks Rank of 1 (Strong Buy). ROST has an expected EPS growth rate of 10.5% for three-five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ross Stores’ current-year sales and EPS suggests a decline of 1.6% and 11.7%, respectively, from the corresponding year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 10.5%, on average.

Dillard's, a retail department stores operator, currently has a Zacks Rank #1. DDS has a trailing four-quarter earnings surprise of almost 144.2%, on average.

The Zacks Consensus Estimate for Dillard's current financial year sales and EPS suggests a growth of 6.6% and 3.4%, respectively, from the year-ago period.

Sprouts Farmers, offers fresh, natural and organic food products. The stock currently carries a Zacks Rank #2. SFM has an expected EPS growth rate of 10.4% for three to five years.

The Zacks Consensus Estimate for Sprouts Farmers’ current financial year revenues and EPS suggests an increase of 4.6% and 9.5%, respectively, from the year-ago reported figure. Sprouts Farmers has a trailing four-quarter earnings surprise of roughly 10%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report