Domino's (DPZ) Beats on Q1 Earnings, Withdraws Guidance

Domino's Pizza, Inc. DPZ reported first-quarter 2020 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate. Notably, this marked the company’s fifth straight quarter of earnings beat. Further, both earnings and revenues have improved year over year. The company also reported robust U.S. same-store sales. The first quarter also marked the 36th straight quarter of positive U.S. comparable sales and the 105th consecutive quarter of positive international comps.

Domino's robust results can primarily be attributed to solid digital ordering system, robust international expansion and other sales initiatives.

Despite reporting better-than-expected results, the company’s shares declined 3.7% yesterday as the company withdrew its long-term guidance. Further, news of international comparable sales declining for the first three weeks of second-quarter 2020 on account of the coronavirus-induced shutdowns hurt investor sentiment. However, the company announced that it is witnessing sales recovery in China.

Earnings & Revenues Discussion

Adjusted earnings in the quarter under review came in at $3.07 per share, which outpaced the Zacks Consensus Estimate of $2.29. The reported figure also improved 39.5% on a year-over-year basis. The bottom line was primarily driven by higher net income and share repurchase program.

Quarterly revenues improved 4.4% year over year to $873.1 million, which beat the consensus mark of $867 million. Higher supply chain volume, and increase in same-store sales and store count both in the United States and international markets drove first-quarter revenues. The company opened 178 gross new stores and 69 net new stores. International franchise revenues also increased. However, the company recorded lower U.S. company-owned store revenues due to the sale of 59 U.S. company-owned stores to existing U.S. franchisees.

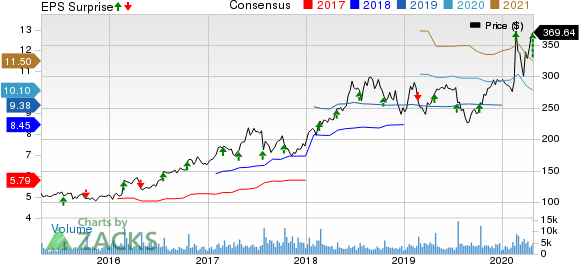

Domino's Pizza Inc Price, Consensus and EPS Surprise

Domino's Pizza Inc price-consensus-eps-surprise-chart | Domino's Pizza Inc Quote

Comps

Global retail sales (including total sales of franchise and company-owned units) improved 4.4% year over year in the first quarter. The upside can primarily be attributed to solid comps at international stores (up 3.9%) and domestic stores (up 4.9%). Excluding foreign currency impact, global retail sales increased 5.9%.

In the first quarter, comps at Domino’s domestic stores (including company-owned and franchise stores) improved 1.6%. However, it was lower than the prior-year quarter’s improvement of 3.9%.

At domestic company-owned stores, Domino’s comps grew 3.9% year over year, higher than 2.1% in the year-ago quarter. Moreover, domestic franchise stores comps increased 1.5% compared with growth of 4.1% in the prior-year quarter.

Comps at international stores, excluding foreign currency translation, were up 1.5%. This was lower than improvement of 1.8% in the year-ago quarter.

Margins

Domino’s operating margin expanded 40 basis points (bps) year over year to 39% in the reported quarter. Operating margin expansion was primarily driven by the New York store sale and increase in revenues from the company’s global franchise business. Moreover, the net income margin expanded 280 bps to 13.9%.

Balance Sheet

As of Mar 22, 2020, cash and cash equivalents totaled $200.8 million, up from $190.6 million as of Dec 29, 2019. Long-term debt at the end of the first quarter was $4,061.2 million, compared with $4,071.1 million as of Dec 29, 2018. Inventory amounted to $49 million at the end of the first quarter.

Cash flows from operating activities totaled $95.4 million at the end of first quarter. In the quarter under review, Domino’s incurred capital expenditures of $17.5 million.

Share Repurchases

During first-quarter 2020, the company repurchased 271,064 shares of its common stock for approximately $79.6 million. As of Mar 22, 2020, the company had nearly $326.6 million remaining under current authorization.

Preliminary Estimates

Domino’s, which has withdrawn its two to three-year guidance citing the coronavirus-induced crisis, provided preliminary estimates for the available period of second quarter. For the first four weeks of the second-quarter, U.S. stores same store sales are anticipated to have improved 7.1%, year over year.

However, for the first three weeks of the second quarter (Mar 23 to Apr 12), international same store sales are expected to have declined 3.2% year over year.

As of Apr 21, almost all of the U.S stores are operational but dine-in services have not been resumed. However, as of Apr 21, there are nearly 1,750 international stores that are still closed.

Zacks Rank & Stocks to Consider

Domino’s, which shares space with Yum! Brands, Inc. YUM, carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space include Yum China Holdings, Inc. YUMC and Potbelly Corporation PBPB. Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Yum China and Potbelly have an impressive long-term earnings growth rate of 8.1 and 17.5%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Yum China Holdings Inc. (YUMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.