Domino's Shares Cool on Disappointing Results, Lower Guidance

Shares of Domino's Pizza Inc. (NYSE:DPZ) declined before the opening bell on Tuesday after reporting disappointing third-quarter results and lowering its long-term sales outlook.

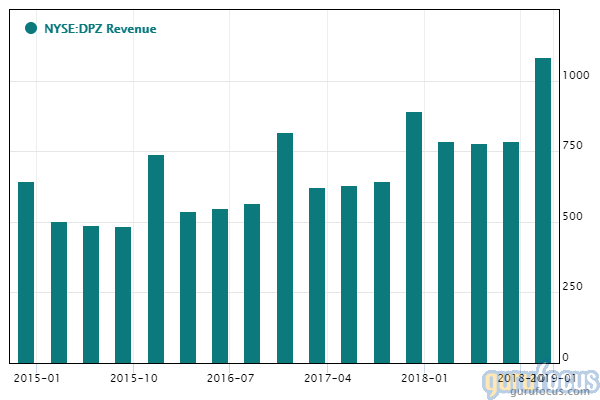

While net income of $86.4 million was up from $84.1 million a year ago, the Ann Arbor, Michigan-based pizza chain's earnings of $2.05 per share were just shy of Refinitiv's estimates of $2.07. Revenue grew 4.4% from the prior-year quarter, but fell short of expectations of $823.9 million.

U.S. same-store sales grew 2.4%, which was below analysts' projections of a 2.8% increase. International same-store sales were up 1.7%, but also missed forecasts of 2.9% growth.

In a statement, CEO Ritch Allison said Domino's has performed well despite headwinds from a "unique competitive environment" with the rise of third-party delivery services. Unlike competitors Papa John's (NASDAQ:PZZA) and Yum Brands' (NYSE:YUM) Pizza Hut, Domino's has rejected partnering with delivery companies like Grubhub (NYSE:GRUB) and DoorDash in favor of opening more locations to decrease delivery times and improve customer service.

This strategy may not be working, however, as the company slashed its long-term sales growth outlook from a range of 8% to 12% to between 7% and 10%. It also lowered its same-store sales forecasts for both the U.S. and international businesses. Domino's now anticipates U.S. same-store sales growth between 2% and 5%. International same-store sales projections were lowered from a range of 3% to 6% to between 1% and 4%.

Net store growth is still expected to increase between 6% and 8% over the next two to three years.

"We remain steadfastly focused on driving profitable growth for the Domino's system, and most importantly, for our franchisees," Allison said.

With a market cap of $9.48 billion, Domino's shares were down 4.11% at $232.26 on Tuesday morning. GuruFocus estimates the stock has tumbled 5% year to date.

Of the gurus invested in Domino's Pizza, Jim Simons (Trades, Portfolio)' Renaissance Technologies has the largest stake with 5.43% of outstanding shares. Steve Mandel (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Ron Baron (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) are also shareholders.

Disclosure: No positions.

Read more here:

5 Undervalued-Predictable Retail Companies to Consider Following Jobs Report

BP CEO Bob Dudley to Step Down in March

4 Consumer Cyclical Companies to Consider as Trade Uncertainty Lingers

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.