Domtar (UFS) Hits 52-Week High: What's Driving the Upside?

Shares of Domtar Corporation UFS scaled a fresh 52-week high of $55.49 during the trading session on Jun 3, before retracting a bit to close at $55.40. The company’s business combination deal with Canada-based Paper Excellence is contributing to this rally. Also, surging demand for softwood and fluff pulp, and an improving demand trend in the paper business are driving the stock-price appreciation.

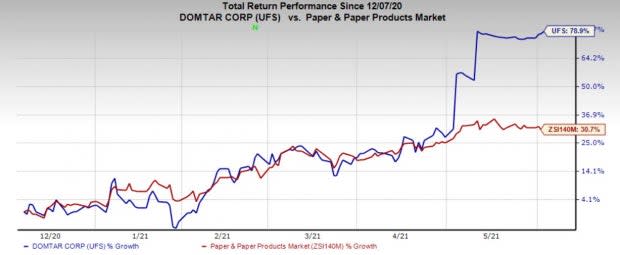

The stock has appreciated 78.9% over the past six months, outperforming the industry’s growth of 30.7%.

Image Source: Zacks Investment Research

The company delivered adjusted earnings of 9 cents per share in first-quarter 2021, against an adjusted loss per share of 27 cents in the prior-year quarter. Domtar has a trailing four-quarter average earnings surprise of 73.4%.

Driving Factors

The company’s pulp business will gain from solid demand for softwood and fluff pulp, and supply constraints. Last month, Domtar announced its plan to expand the Georgia-based Engineered Absorbent Materials (EAM) facility. This move will aid the company to grow its leading global absorbent materials and technology business offering fluff pulp and airlaid non-woven materials.

In the paper business, the company has been witnessing improved sales over the past few months. Demand is anticipated to pick up further as people return to schools and offices. The price-rise actions, and efforts to lower costs in both pulp and paper business will aid the company. It is on track to deliver annual run-rate cost savings of $200 million by the end of 2021.

In March, Domtar completed the sale of its Personal Care division to American Industrial Partners for $920 million. The divestiture supports Domtar’s primary focus on building an industry-leading Paper, Pulp and Packaging business.

The company has identified up to four large scale paper machine/mill repurposing projects that have the ability to produce 2.5 million tons of containerboard. Given this growth prospects, Domtar plans to foray in the containerboard market with the conversion of its Kingsport, TN paper mill. Once fully operational, the mill will become the second largest recycled containerboard machine in North America, with an annual production capacity of around 600,000 tons of high-quality recycled linerboard and corrugated medium. It has the potential to become one of the lowest-cost recycled containerboard mills in the United States. The conversion is expected to be completed by the end of 2022.

Last month, Domtar entered into an agreement with Paper Excellence, per which the latter will acquire all of the issued and outstanding shares of Domtar common stock for $55.50 per share, in cash. This represents Domtar’s enterprise value of $3 billion. The transaction is expected to close in the second half of the current year. Paper Excellence intends to continue the operations of Domtar as a stand-alone business entity. This buyout marks Paper Excellence’s foray into the American market and will help the company bank on Domtar’s expansive global footprint.

Positive Growth Projections

The Zacks Consensus Estimate for the company’s current-year earnings is currently pegged at $4.85, suggesting a whopping 24,150% growth from earnings of 2 cents per share in 2020.

Zacks Rank & Other Stocks to Consider

Domtar currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

A few other similarly-ranked stocks in the basic materials space are ArcelorMittal MT, Cabot Corporation CBT and Dow Inc. DOW.

ArcelorMittal has a projected earnings growth rate of 984.7% for the current year. The company’s shares have soared nearly 179% in the past year.

Cabot has an expected earnings growth rate of 125.9% for fiscal 2021. The company’s shares have rallied 79.4% over the past year.

Dow has an estimated earnings growth rate of 261.6% for the ongoing year. The company’s shares have gained roughly 78% in a year’s time.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Domtar Corporation (UFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research