Don’t Chase the Storm in Home Depot Stock

Most analysts have consistently touted Home Depot (NYSE:HD) this year, and for good reason. Year-to-date, Home Depot stock has returned shareholders 12.6%. While I wouldn’t call this haul remarkable in and of itself, as a consumer staple, you couldn’t ask for more.

Another powerful element moving in favor toward HD stock is its resilience toward Amazon (NASDAQ:AMZN) or any would-be e-commerce competitor. Sure, Amazon has disrupted several industries, and now they’re eyeing home improvement. That doesn’t scare HD as the company levers both a popular brick-and-mortar solution, and an online channel.

But with Home Depot stock closing up Monday at an all-time high, that dynamic lends itself to an obvious question: Is now the time to dump Home Depot shares?

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

On the surface level, HD stock appears overextended. As a secular name, you worry about shares getting ahead of themselves. HD opened this week with a strong 2% performance in the markets, but on no direct news. Therefore, a healthy correction seems logical.

At the same time, CNBC reported a literal tailwind for Home Depot stock. With Hurricane Florence forecasted to strike the southeastern region of the U.S., HD shares, along with rival Lowe’s (NYSE:LOW), have enjoyed speculative sentiment.

Risk-tolerant investors are gambling that sales of plywood, generators and other home-improvement products will spike during this storm season.

Initially, this argument makes perfectly logical sense. Weather experts have reported that Florence strengthened into a category 4 storm, implying significant damages. As cynical of a play towards Home Depot stock as this is, it’s also incredibly shrewd.

But is this tactic effective? The actual numbers provide a more nuanced story.

Are Storms Actually Beneficial for Home Depot Stock?

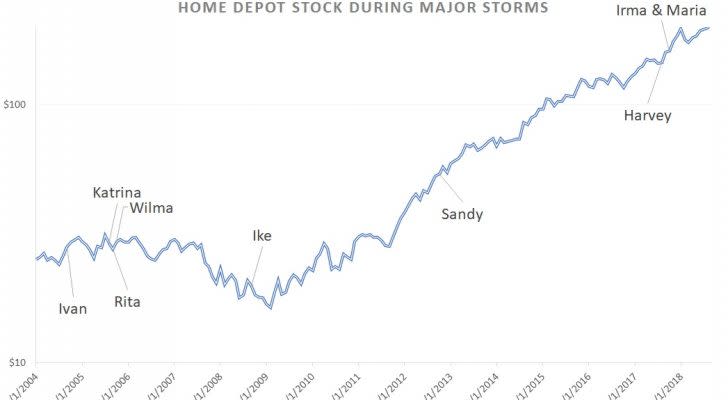

To answer this question, I foolishly had the idea of juxtaposing the Home Depot stock price against all major storms. I realized very quickly that this was a gargantuan task. Plus, I’d make my editors extremely angry and that is never a good thing in my business.

Therefore, I settled on the top ten most-economically damaging storms, according to Weather.com. If HD stock benefited from increased emergency-products sales, I should see a convincing trend against the worst storms ever. But the data provided mixed results, with my conclusion being that HD benefits only from “contextually favorable storms.”

Allow me to explain:

Of the top-ten worst storms, Home Depot stock gained an average of 1.8% from the month before the tempest to the month during. Considering that the average month-over-month gain in HD is only 0.9% since January 2000, this storm-based lift is fairly impressive.

But before you jump on board the home-improvement bandwagon, HD has a somewhat negative correlation with resultant economic damages. In other words, the more damage a storm causes, the less likely that HD stock will benefit.

As an example, hurricanes Ivan, Rita and Wilma each produced less than $30 billion in damages. During their storm months, Home Depot stock gained an average 3.3%. On the other hand, hurricanes Andrew, Katrina, Ike, Sandy, Harvey, Irma and Maria caused $82.5 billion in damages, and HD averaged 2.3%.

Hurricane Katrina represents the most extreme example. With $160 billion in damages, HD stock tanked over 7%. On the other end of the spectrum, Irma and Maria caused $50 billion and $90 billion in damages, respectively. Yet shares skyrocketed nearly 10%.

Be Smart About Storm-Chasing HD stock

Admittedly, this sample size is very small. I suspect, though, that if I broadened the scope to include the top 20 or 30 most damaging storms, we’d see similar trends. Primarily, I say this because the contextual correlation makes sense.

Katrina devastated Louisiana, and particularly New Orleans. Several impacted areas have yet to fully recover. That’s net negative for HD stock. Temporary increases in plywood and generators are offset by profound economic damages. Moreover, many lower-income families in those regions couldn’t afford emergency supplies anyways.

I can make the same argument about Hurricane Harvey. Not only did Harvey caused $125 billion in damages, it took 106 American lives. Additionally, the mega-storm hit regions that really couldn’t afford it financially. Subsequently, HD stock barely moved.

Sandy, on the other hand, lashed out its severity toward the northeastern states. Although it was incredibly damaging at $70.2 billion, Sandy victims could better absorb the financial strain. Home Depot stock increased 1.7% during this storm.

Of course, outliers exist that contradict these trends and my thesis. Which is why I wouldn’t play storm-chaser with HD stock. Instead, buy this home-improvement giant for its strong business, and its distinct ability to remain relevant in all circumstances.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Don’t Chase the Storm in Home Depot Stock appeared first on InvestorPlace.