Don’t Lose Your Crypto! 3 Ways DEXs Keep Your Funds Super Safe

By CCN: The recent Binance hack was a rude wake-up call to the entire crypto community. Some 7,000 bitcoins worth more than $40 million were taken from the centralized exchange. While crypto exchange hacks are nothing new, the Binance security breach was particularly shocking because the platform managed to attain a high level of confidence from the community. The saying “not your keys, not your coins” is relevant now more than ever. Let’s explore a viable alternative that can virtually guarantee fund security without compromising your trading experience. Here are three ways decentralized exchanges (DEXs) keep your funds absolutely safe.

1. Your Keys, Your Coins

A decentralized exchange is a platform that doesn’t require a third-party service provider, such as Coinbase or Binance, to pool and hold users’ funds. Instead, trades occur directly between users via peer to peer (P2P) transfers. The DEX eliminates the middleman, and this comes with serious advantages for fund security. No. 1 is that you no longer need to deposit funds onto an exchange.

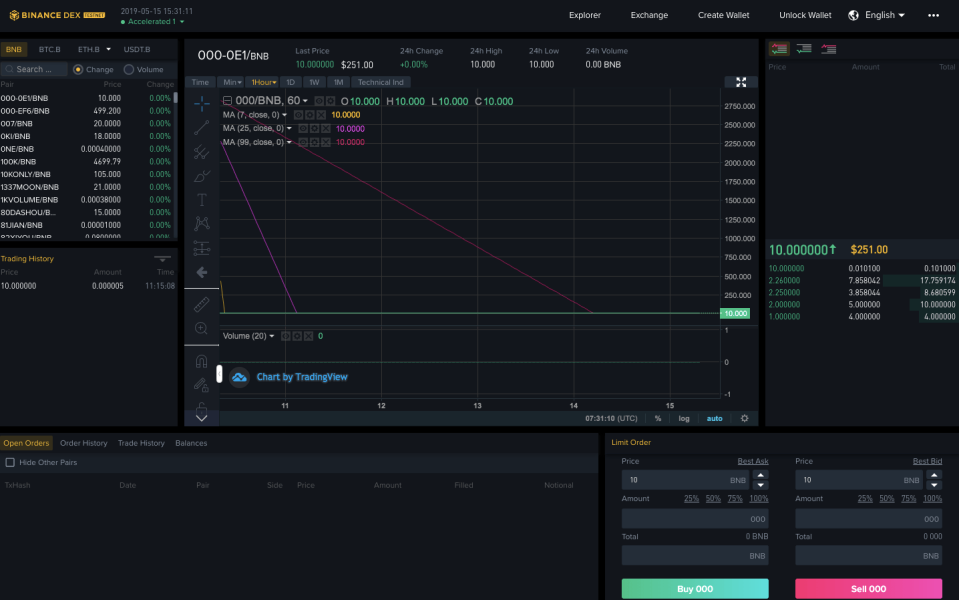

The interface of a DEX is not so different from the interface of a centralized exchange | Source: Binance DEX TestNet

Without a central authority to act as the trade facilitator, you have 100% control of your funds. You manage the keys to your wallet, which means you are the only one who can access your coins. Unless someone gets ahold of your keys or password, your funds are safe.

2. With DEX Withdrawals Become a Thing of the Past

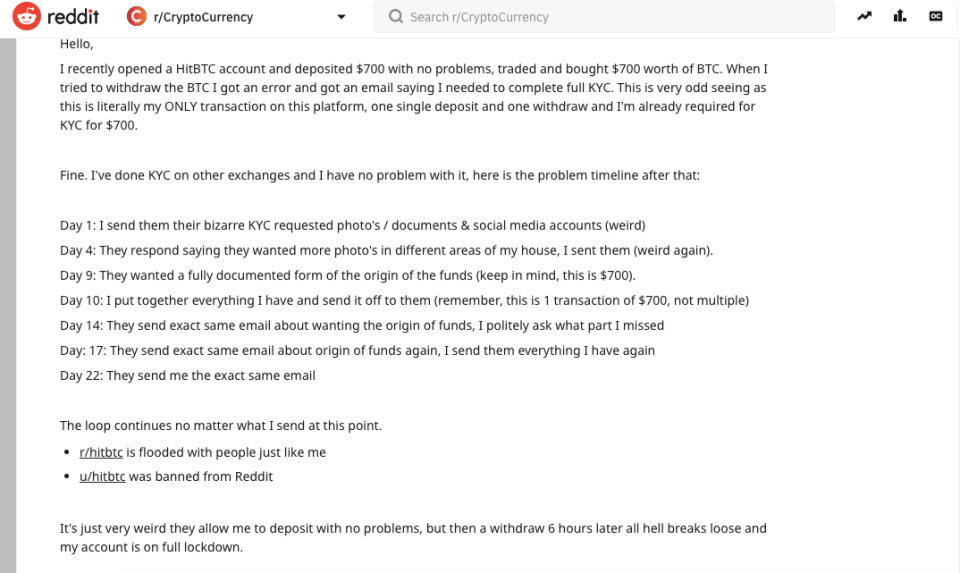

On social media, we’ve heard nightmarish stories of users who can’t withdraw their cryptocurrencies from centralized exchanges for various reasons. For instance, a Reddit member documents their experience on HitBTC. The investor bought $700 worth of bitcoin and tried to withdraw only to get an error and an email explaining how they must complete the know your customer (KYC) process. The person completed all the steps and sent documents required by the exchange which strangely included photos of the user’s house.

In the end, it took more than 22 days and a Reddit post to force the exchange to release the funds.

Reddit user detailing a horrible experience with a centralized exchange | Source: Reddit