Donald Smith Adds 2 Industrial Stocks to Portfolio in 3rd Quarter

Donald Smith (Trades, Portfolio), the founder and leader of investment firm Donald Smith & Co., released his third-quarter portfolio last week, listing two new holdings.

Using a deep-value, bottom-up approach, the guru's New York-based firm typically invests in out-of-favor stocks that are trading at a discount to tangible book value. According to the firm's website, the portfolio managers look for opportunities among companies that are in the bottom decile of price-tangible book ratios and have a positive earnings outlook over the next two to four years.

Based on these criteria, Smith established positions in Atlas Air Worldwide Holdings Inc. (NASDAQ:AAWW) and CAI International Inc. (NYSE:CAI) during the quarter.

Atlas Air Worldwide

The guru invested in 1.2 million shares of Atlas Air, dedicating 1.16% of the equity portfolio to the stake. The stock traded for an average price of $32.68 per share during the quarter.

The Harrison, New York-based cargo airline, which also provides charter airline and aircraft leasing services, has a $650.26 million market cap; its shares were trading around $25.14 on Tuesday with a price-earnings ratio of 4.56, a price-book ratio of 0.3 and a price-sales ratio of 0.26.

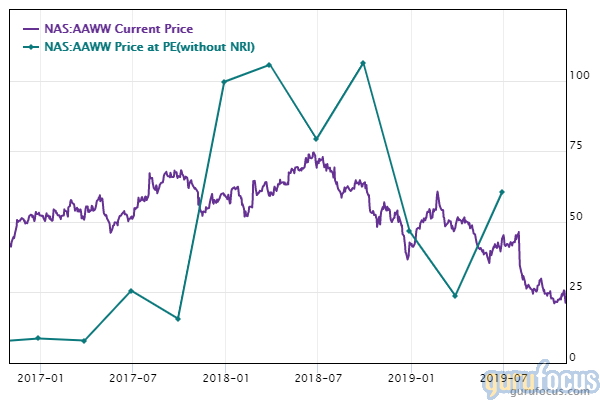

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated Atlas Air's financial strength 3 out of 10. As a result of issuing approximately $475.4 million in new long-term debt over the past three years, the company has poor interest coverage. In addition, the Altman Z-Score of 1.06 warns the company is in financial distress and could be at risk of going bankrupt.

The company's profitability fared better, scoring a 7 out of 10 rating on the back of strong margins and returns that outperform over half of its competitors. Atlas also has a moderate Piotroski F-Score of 6, which indicates operating conditions are stable, and a business predictability rank of one out of five stars despite recording a slowdown in revenue per share growth over the past 12 months. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

With his purchased of 4.66% of outstanding shares, Smith became the company's largest guru shareholder. Richard Snow (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Chuck Royce (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies and Joel Greenblatt (Trades, Portfolio) also own the stock.

CAI International

Smith picked up 49,460 shares of CAI International, allocating 0.04% of the equity portfolio to the position. Shares traded for an average price of $22.07 during the quarter.

Headquartered in San Francisco, the transportation company, which offers intermodal container leasing and sales, rail leasing and logistics services, has a market cap of $414.91 million; its shares were trading around $23.02 on Tuesday with a price-earnings ratio of 13.52, a price-book ratio of 0.7 and a price-sales ratio of 0.99.

According to the Peter Lynch chart, the stock is undervalued.

CAI's financial strength was rated 3 out of 10 by GuruFocus. As a result of issuing approximately $797.42 million in new long-term debt over the last three years, the company has low interest coverage. In addition, the Altman Z-Score of 0.71 warns the company could be in danger of going bankrupt.

The company's profitability scored a 9 out of 10 rating. Although the operating margin is in decline, it still outperforms a majority of industry peers. In addition, CAI is supported by consistent earnings and revenue growth, a moderate Piotroski F-score of 6 and a three-star business predictability rank. GuruFocus says companies with this rank typically see their stocks gain an average of 8.2% per year.

Royce is the company's largest guru shareholder with 1.89% of outstanding shares. Smith holds 0.28%.

Additional trades

During the quarter, Smith also boosted a number of holdings, including Gold Fields Ltd. (NYSE:GFI), Iamgold Corp. (NYSE:IAG), JetBlue Airways Corp. (NASDAQ:JBLU), CorePoint Lodging Inc. (NYSE:CPLG), Jefferies Financial Group Inc. (NYSE:JEF), Tutor Perini Corp. (NYSE:TPC), Unum Group (NYSE:UNM) and International Seaways Inc. (NYSE:INSW).

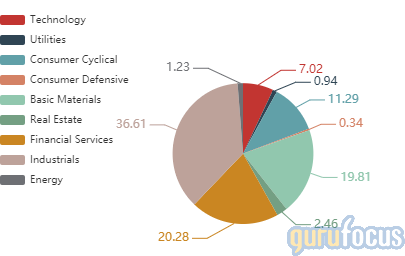

The guru's $2.62 billion equity portfolio, which is composed of 60 stocks, is largely invested in the industrials sector, followed by smaller positions in the financial services and basic materials sectors.

Disclosure: No positions.

Read more here:

Eaton Vance Worldwide Health Sciences Fund Buys 2 Stocks

Google Gets in Shape With Fitbit Acquisition

Howard Marks' Oaktree Digs Out of StoneMor Partners

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.