Donaldson's (DCI) Prospects Bleak on Coronavirus Scares

Donaldson Company, Inc. DCI seems to have lost its growth momentum to the pandemic. It also faces headwinds from forex woes and high leverage. Notably, the company’s price performance has been weak and its earnings estimates have also been lowered lately, pointing toward bearish sentiments for the stock.

The company has a market capitalization of $6.2 billion and a Zacks Rank #4 (Sell) at present. It belongs to the Zacks Pollution Control industry, currently at the top 29% (with the rank of 73) of more than 250 Zacks industries.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In third-quarter fiscal 2020 (ended Apr 30, 2020), the company’s earnings and sales surpassed estimates by 31.6% and 3.9%, respectively. However, on a year-over-year basis, its earnings declined 13.8% on weak sales performance and a fall in margins.

Year to date, the company’s shares have fallen 13.8% compared with the industry’s decline of 10.1%.

Factors Affecting Investment Appeal

Pandemic-Related Woes: Donaldson suffered from the adverse impacts of the pandemic in third-quarter fiscal 2020. Its sales in the quarter declined 11.7% year over year, with an organic sales decline of 9.7%. The performance was weak in the United States; Europe, Middle East and Africa; the Asia Pacific and Latin America as well as in Engine Products and Industrial Products segments.

The company expects the pandemic-related uncertainties to continue impacting its operations in the quarters ahead. Projections for both fiscal 2020 (ending July 2020) and 2021 (ending July 2021) were kept suspended. However, it did mention that sales in May will likely fall 24% year over year.

The Zacks Consensus Estimate for the company’s revenues is pegged at $2.55 billion for fiscal 2020, suggesting a decline of 10.5% from the year-ago reported number.

Leverage: High debts increase financial obligations and, in turn, hurt profitability. Donaldson’s long-term debts were $735.1 million at the end of third-quarter fiscal 2020, while its cash and cash equivalents were just $326.5 million. Interest expenses in the quarter totaled $4.4 million.

Also, the company seems to be more leveraged than the industry. Its debt to equity of 82.8% is higher than the industry’s 73.7%, while its long-term debt to capital was at 45.6% versus the industry’s 39.1%. Times interest earned in the quarter remained stable sequentially at 19.8x.

Woes Related to International Presence: The company has a diversified business structure, having operations in multiple countries. The diversification has exposed the company to geopolitical issues, macroeconomic challenges and unfavorable movements in foreign currencies. In the third quarter, its sales declined 2% on forex woes.

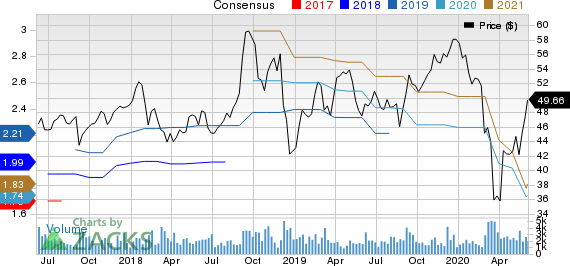

Bottom-Line Estimate Trend: The Zacks Consensus Estimate for Donaldson’s earnings has moved downward in the past seven days. The consensus estimate for earnings is currently pegged at $1.74 for fiscal 2020 and $1.79 for fiscal 2021, suggesting a decline of 1.1% and 1.6% from the seven-day-ago numbers. Notably, one downward revision each was recorded for the years in the past week.

Donaldson Company, Inc. Price and Consensus

Donaldson Company, Inc. price-consensus-chart | Donaldson Company, Inc. Quote

Donaldson’s Performance Versus Three Peers

The company has underperformed three peers since the beginning of 2020. Three such stocks are Danaher Corporation DHR, Parker-Hannifin Corporation PH and Eaton Corporation plc ETN, with respective year-to-date growth of 10.5%, decline of 4.7% and fall of 5.7%.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ParkerHannifin Corporation (PH) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research