Don't Dump Apple Stock Just Yet

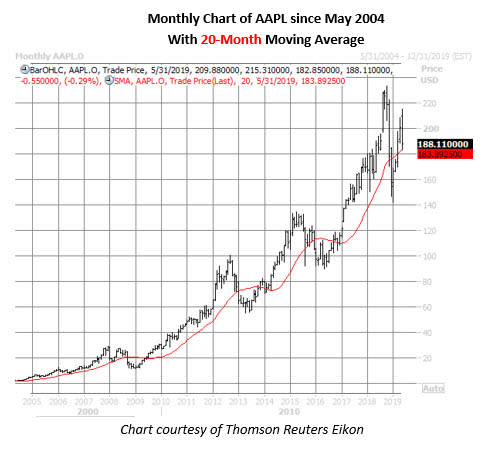

It's been a bumpy ride for Apple Inc. (NASDAQ:AAPL) in recent weeks, with the FAANG stock pressured by increasing U.S.-China trade tensions, as well as an unfavorable Supreme Court ruling. All hope is not lost for the tech shares, though, considering they are now trading near a trendline that's had bullish implications for AAPL in the past.

Specifically, Apple stock is trading within one standard deviation of its 20-month moving average. According to Schaeffer's Senior Quantitative Analyst Rocky White, there have been seven other times in the past 15 years AAPL has tested support at this trendline after a lengthy stretch above it, defined for this study as having traded above the moving average 80% of the time for the last 20 months. Following these previous signals, the shares averaged a three-month gain of 12%.

Based on the stock's current perch at $188.11 -- down 0.3% today on news Jana Partners dissolved its stake in the Apple -- another move of this magnitude would put AAPL back near $210, the site of its May 2 close. And while the shares have retreated from here, they are still boasting a 19.3% year-to-date gain, and recently bounced from their rising 80-day moving average.

Another big bounce for AAPL stock could shake some of the weaker bearish hands loose, which may create stronger tailwinds for the security. For starters, 12 of 26 covering analysts maintain a tepid "hold" recommendation on Apple, while the average 12-month price target of $216.17 is a mild 14.9% premium to current trading levels.

Plus, although short interest fell 22.3% in the two most recent reporting periods, there are still 52.67 million AAPL shares sold short. It would take bears almost three days to cover these remaining shares, at the stock's average pace of trading.