Dover (DOV) Beats on Q1 Earnings, Suspends 2020 Guidance

Dover Corporation DOV reported first-quarter 2020 adjusted earnings per share from continuing operations of $1.39. The figure improved 12% from the prior-year quarter’s $1.24 per share. Earnings also beat the Zacks Consensus Estimate of $1.18. Despite lower revenues in the quarter thanks to the impact of the coronavirus pandemic, Dover’s productivity initiatives, cost-containment efforts and prudent debt refinancing undertaken in late 2019 were instrumental in driving bottom-line growth.

On a reported basis, Dover delivered earnings per share of $1.21 in the March-end quarter, reflecting a year-over-year jump of 68.1%.

Total revenues in the first quarter came in at $1,656 million, marking a decline of 4% from the year-ago quarter’s $1,725 million. The revenue figure missed the Zacks Consensus Estimate of $1,665 million. Pandemic-related challenges, mainly in China and Italy, along with the challenging trading conditions in the capital goods and textile sectors dented the company’s revenues in the reported quarter.

Costs and Margins

Cost of sales fell 5.2% year over year to $1,044 million during the January-March quarter. Gross profit edged down 1.8% year over year to $612.2 million.

Selling, general and administrative expenses slipped 5.1% to $387 million from the $409 million reported in the prior-year quarter. Operating profit increased to $225 million from the year-ago quarter’s $168 million.

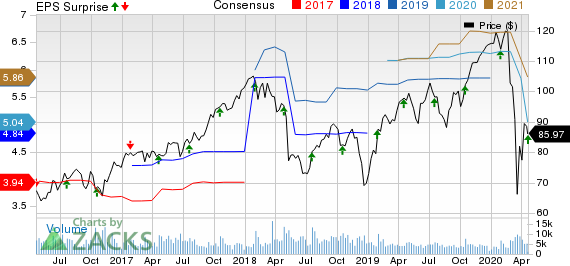

Dover Corporation Price, Consensus and EPS Surprise

Dover Corporation price-consensus-eps-surprise-chart | Dover Corporation Quote

Segmental Performance

The Engineered Products segment revenues went down to $408 million from the $419 million recorded in the year-ago quarter. The segment’s income increased 3% year over year to $69 million.

The Fueling Solutions segment revenues declined to $360 million from the $373 million recorded in the prior-year quarter. The segment’s income jumped 43.2% year over year to $53.5 million.

The Imaging & Identification segment revenues went down to $257 million from the $268 million recorded in the comparable period last year. The segment’s income declined 8% year over year to $51.5 million.

The Pumps & Process Solutions revenues dropped 3.2% year over year to $319.5 million in the quarter. The segment income came in at $66 million compared with the year-ago quarter’s $15 million.

The Refrigeration & Food Equipment segment’s revenues declined 6.9% to $312 million from the year-earlier quarter’s $335 million. The segment’s operating income decreased 5.5% year over year to $23.5 million.

Bookings and Backlog

Dover’s bookings at the end of the first quarter were worth $1.78 billion, flat year over year. Backlog increased 12% year over year to $1.59 billion at the end of the reported quarter.

Financial Position

Dover generated free cash flow of $35.7 million in the reported quarter compared with cash outflow of $12.6 million in the prior-year quarter. Cash flow from operations came in at $75.9 million in the March-end quarter compared with the year-ago period’s $24.5 million.

Outlook

Dover has withdrawn its current-year revenue and adjusted EPS guidance on account of the uncertainty related to the coronavirus pandemic and its negative impact on the demand environment.

The company’s financials have been affected by the pandemic and related measures imposed by governments around the world as well as increased business uncertainty.

Share Price Performance

Dover, along with Tennant Company TNC and Broadwind Energy, Inc. BWEN, are part of the Manufacturing – General Industrial industry. Dover’s shares have lost 12.2% over the past year compared with the industry’s loss of 17.2%.

Zacks Rank and A Stock to Consider

Dover currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the Industrial Products sector is Sharps Compliance Corp. SMED, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Sharps Compliance has an estimated earnings growth rate of 800% for 2020. In a year, the company’s shares have soared 114%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

Sharps Compliance Corp (SMED) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

Broadwind Energy, Inc. (BWEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.