Dow 30 Stock Roundup: Disney's Earnings Impress, Walmart Buys Flipkart Stake for $16B

The Dow enjoyed a week of strong gains, shrugging off the gloom of the last two weeks. President Trump’s decision to exit the Iran deal weighed on investor sentiment. However, this development also boosted oil prices, leading to a rally for energy stocks. Tech stocks continued to register strong performances while economic data remained encouraging.

Last Week’s Performance

The Dow advanced 1.4% on Friday boosted by a broader tech rally. The rally was led by Apple Inc. AAPL after Warren Buffett’s Berkshire Hathaway Inc. BRK.B announced that it has increased its stake in the iPhone maker. Moreover, weaker-than-expected U.S. wage growth also somewhat eased fears inflationary fears. These positives overshadowed the uncertainty over U.S.-China trade talks.

The index lost 0.2% over last week. Market declined on the first two days of last week after healthcare and industrial stocks took a hit, followed by poor economic data. The middle of the week started on a high after Fed announced that it will keep its monetary policy unchanged.

However, as fears of U.S.-China trade war escalated once again, markets took a hit. Even Apple’s robust earnings results failed to cheer up markets, as inflationary fears once again gripped markets, resulting in panic selling in the late hours on Wednesday. However, markets finally bounced back on Friday with tech stocks rallying, led by Apple, which somewhat erased inflationary and trade war fears.

The Dow This Week

The index gained 0.4% on Monday driven by a rally in tech stocks and an increase in oil prices. However, stocks suffered a pullback later in the trading session after President Donald Trump tweeted that he would be take a decision on the Iran deal on Tuesday. The rally in tech stocks was led by Apple, which continued its six-day long winning streak.

The index increased less than 0.1% on Tuesday despite President Donald Trump’s announcement that the United States was withdrawing from the Iran nuclear deal. The index had lost as much as 60 points at one time following Trump’s announcement. The broader energy sector overcame earlier losses, as oil prices erased declines on anticipation that sanctions would disrupt crude supplies globally.

The index gained 0.8% on Wednesday, driven by a rally in tech stocks. Oil prices hit a three and-half-year high, boosting energy stocks. The rise in oil prices followed President Donald Trump’s decision to pull out of the Iran nuclear deal a day earlier. Moreover, the broader market also got a boost from financial stocks.

The index increased 0.8% on Thursday, boosted once again by tech stocks. This was the sixth consecutive session that the finished in the green, the longest such period in two months. Also boosting sentiment was a lackluster increase in CPI data, suggesting that recent worries over inflation may have been uncalled for. Meanwhile, weekly jobless claims lingered near its lowest point in 49 years.

Components Moving the Index

The Walt Disney Company DIS delivered second-quarter fiscal 2018 adjusted earnings of $1.84 that beat the Zacks Consensus Estimate by 16 cents and surged 23% from the year-ago quarter. Revenues increased 9.1% from the year-ago quarter to $14.55 billion that comfortably surpassed the consensus mark of $14.23 billion.

Services (86.1% of revenues) increased 9% year over year to $12.52 billion. Products (13.9% of revenues) jumped 9.7% from the year-ago quarter to $2.03 billion.

Media Networks (42.2% of revenues) revenues inched up 3.2% year over year to $6.14 billion. Cable Networks climbed 4.7% to $4.25 billion while broadcasting revenues remained almost flat at $1.89 billion.

Zacks Rank #3 (Hold) Disney now expects BAMTech to hurt Media Networks’ fiscal 2018 operating income by $180 million year over year, $50 million higher than previous estimate, primarily due to increased investment in ESPN+. Management expects $100 million negative impact in the third quarter. (Read: Disney Q2 Earnings & Revenues Top, Black Panther Roars)

Walmart Inc. WMT has clinched contracts to buy an initial stake of 77% in Flipkart for roughly $16 billion. With the latest move, the world’s largest retailer defeated Amazon.com, Inc. (AMZN) in its prolonged fight to snap up a stake in India’s leading e-commerce player.

Zacks Rank #4 (Sell) Walmart is acquiring a major stake in Flipkart, while the remaining stake will remain with Flipkart’s co-founder Binny Bansal, Tencent Holdings Limited, Tiger Global Management LLC and Microsoft (MSFT). The deal, which is expected to close toward the end of this calendar year, remains subject to regulatory approval.

Following the deal, both Walmart and Flipkart will continue operating as distinct brands, while retaining their operating structure. Flipkart’s financials will form part of Walmart’s international segment following the conclusion of the transaction. Further, Tencent and Tiger Global remain on Flipkart’s board, and will be joined by additional members from Walmart.

Also, the investment by Walmart includes new equity funding of nearly $2 billion, which is most likely to propel growth at Flipkart. While both entities are in talks with other potential investors, Walmart will hold a solid majority stake in Flipkart. (Read: Walmart to Snap Up Stake in Flipkart: Pros & Cons of the Deal)

Exxon Mobil Corporation XOM recently agreed to divest three fuel terminals and a refinery in Italy to Algerian state-run energy producer Sonatrach. Employees in the facilities will work for the acquirer following the closure of the deal.

Exxon's Italian unit, Esso Italiana Srl will sell its 175,000 barrel a day refinery in Augusta, Sicily and three fuel terminals located in Augusta, Naples and Palermo, along with their related pipelines, to Sonatrach.

The financial details of the deal — expected to close by the end of this year — are yet to be disclosed. Around 660 workers currently engaged in the properties will work for the acquirer, following the completion of the divestment. The stock has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Boeing Company’s BA president, chairman and CEO said on May 9 that the company will take steps to ascertain that production of its 737 jets is not affected as a result of the United States’ decision to exit the Iran nuclear deal. Following President Trump’s decision to withdraw from the agreement, Boeing is expected to incur a potential loss of $20 billion in sales to Iranian airlines.

On May 8, U.S. Treasury Secretary Steven Mnuchin had announced that Boeing and Airbus Group (EADSY) would lose their licenses to sell passenger aircraft to Iran as part of the sanctions to be imposed due to the decision to exit the Iran nuclear deal. IranAir had agreed to purchase 100 and 80 aircraft from Airbus and Boeing, respectively. However, these agreements now stand suspended.

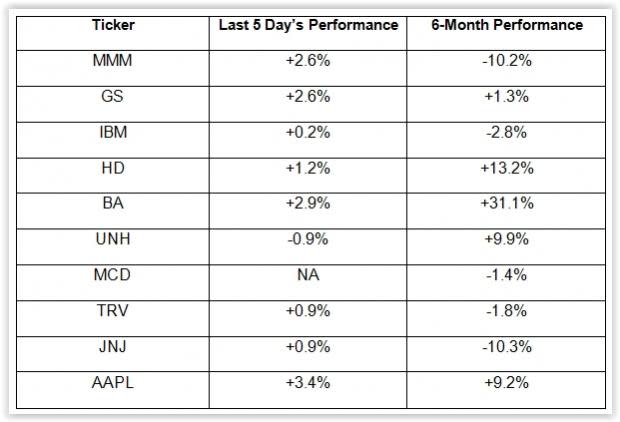

Performance of the Top 10 Dow Companies

The table given below shows the price movements of the 10 largest components of the Dow, which is a price weighted index, over the last five days and during the last six months. Over the last five trading days, the Dow has gained 1.5%.

Next Week’s Outlook

Markets are enjoying their best week in recent times. Meanwhile, the market’s fear gauge, the VIX has dropped to pre-correction levels. This indicates the level of calm prevailing in the markets. Economic data has also been largely helpful in nature.

Meanwhile, a strong earnings season is continuing to exceed expectations. And while President Trump’s decision to exit the Iran deal hasn’t gone down well with investors, they seem to have taken it in their stride. Overall, stocks are in a good position to continue moving higher in the week ahead.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

The Boeing Company (BA) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research