DOW Launches Moldable Optical Silicone, Boosts Portfolio

Dow Inc. DOW recently launched Silastic MS-5002 Moldable Silicone, a specialized liquid silicone rubber with very low mold fouling for faster cycle times and high-quality optics in automotive adaptive driving beam (“ADB”) light guides.

The optical matrix lens molders are moving toward manufacturing quality parts with higher throughput and less preventive maintenance as the market trend for ADB headlights ramps up to mass production. This new material has been created for injection molded parts with less-complex geometries that require high-productivity manufacturing. It also comes with high transparency and non-yellowing to enhance LED light output, and a wide processing window.

Silastic MS-5002 Moldable Silicone complements and boosts Dow’s existing portfolio of moldable optical materials for ADB headlights, including Silastic MS-1002, Silastic MS-1001 and Silastic MS-4002 Moldable Silicone grades.

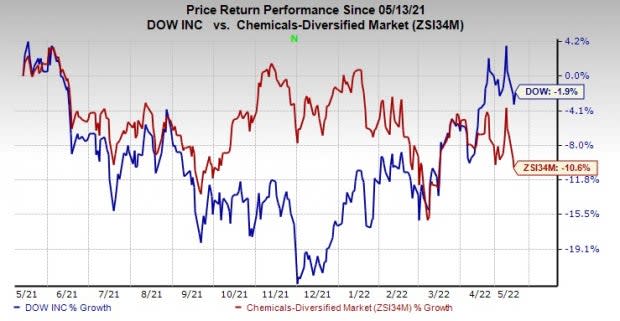

Shares of Dow have dropped 1.9% in the past year compared with a 10.6% decline of the industry.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that it expects demand strength across its end markets to continue. It is advancing its strategy to decarbonize its assets and grow underlying earnings by more than $3 billion in the transition to a more sustainable world. The company is well-placed to achieve mid-cycle earnings above pre-pandemic levels as it captures higher demand for lower carbon and circular solutions.

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

Zacks Rank & Other Key Picks

Dow currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Nutrien Ltd. NTR, Allegheny Technologies Incorporated ATI and Cabot Corporation CBT.

Nutrien has a projected earnings growth rate of 161.9% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 38.8% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, while missing once. It has delivered a trailing four-quarter earnings surprise of roughly 5.9%, on average. NTR has rallied around 63.6% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allegheny has a projected earnings growth rate of 869.2% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 27.3% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 128.9%. ATI has gained 14.1% in a year. The company flaunts a Zacks Rank #1.

Cabot, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 19.5% for the current year. The Zacks Consensus Estimate for CBT's earnings for the current year has been revised 3.4% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 6.1% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research