It's Down 63% But ViewRay, Inc. (NASDAQ:VRAY) Could Be Riskier Than It Looks

ViewRay, Inc. (NASDAQ:VRAY) shareholders that were waiting for something to happen have been dealt a blow with a 63% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

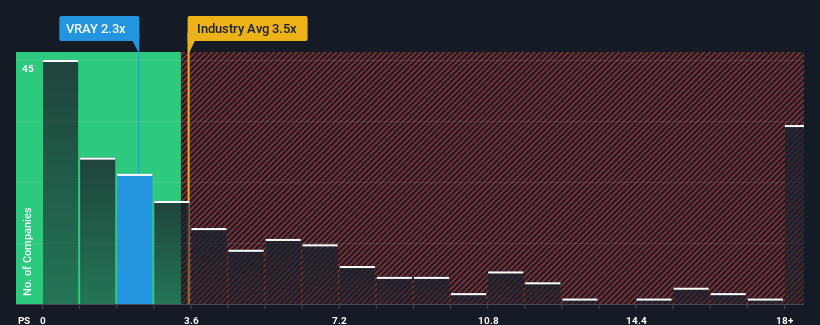

Since its price has dipped substantially, ViewRay may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.3x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for ViewRay

How ViewRay Has Been Performing

ViewRay certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ViewRay.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, ViewRay would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. The latest three year period has also seen a 16% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.9% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that ViewRay's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does ViewRay's P/S Mean For Investors?

ViewRay's recently weak share price has pulled its P/S back below other Medical Equipment companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems ViewRay currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for ViewRay that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here