Dr Pepper & Keurig Merger Nears Completion, Forms Board

Dr Pepper Snapple Group, Inc. DPS and Keurig Green Mountain have announced the board of directors of the new company — Keurig Dr Pepper — after the shareholders of Dr Pepper unanimously voted in favor of the merger deal on Jun 29. With other necessary regulatory approvals for the deal already obtained in the United States and Canada, the companies are on track to close the transaction on Jul 9. Moreover, on Jul 10, Keurig Dr Pepper will start trading on the New York Stock Exchange, under the new ticker symbol — “KDP”.

The board will include 12 members, working under the leadership of CEO Bob Gamgort. The board members will work together to make KDP a leading beverage company, delivering upon substantial value creation opportunities.

This merger announcement dates back to January 2018 when the leading coffee maker, Keurig Green Mountain, Inc., agreed to buy Dr Pepper Snapple. Under the terms of the deal, the company’s shareholders will receive a special cash dividend of $103.75 per share, making the deal worth $18.7 billion. Dr Pepper Snapple’s shareholders will retain 13% ownership of the combined entity while Keurig shareholders will own 87%.

Previously, it was revealed that European investment fund JAB Holding will make a $9-billion equity investment to finance the transaction. Also, Mondelez International, Inc. MDLZ, JAB Holding's partner in Keurig, was about to have 13-14% stake in the merged entity.

The combined company, Keurig Dr Pepper, will have $11 billion in combined pro forma revenues and will realize $600 million in synergies on an annualized basis by 2021. This will make it the seventh-largest company in the U.S. food and beverage sector, and the third-largest non-alcoholic beverage company. The company’s portfolio will contain a number of iconic brands, including Dr Pepper, 7UP, Snapple, A&W, Mott’s, Canada Dry and Clamato, among others. The merged entity is likely to gain from Dr Pepper Snapple's distribution network while Keurig's online presence will boost sales through digital platforms like Amazon.com, Inc. AMZN. In fact, analysts are of opinion that the combined company can pose tough competition to beverage giants, including The Coca-Cola Company KO.

We note that Dr Pepper Snapple has been witnessing weak volumes of carbonated beverages, including the diet versions, owing to CSD category headwinds. Further, cross-category competition, and growing health and wellness consciousness among consumers are hurting CSD category growth. Moreover, new taxes on sugar-sweetened beverages and growing regulatory pressures are affecting CSD sales. Consequently, the company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

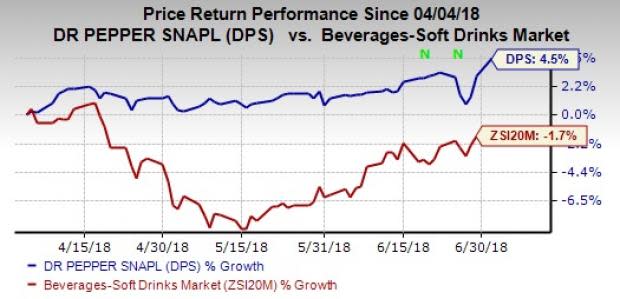

Shares of Dr Pepper increased 1.4% yesterday. Moreover, the stock has gained 4.5% in the last three months against the industry’s decline of 1.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

Dr Pepper Snapple Group, Inc (DPS) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research