Dr. Reddy's (RDY) Q4 Earnings Decline Y/Y, Sales Increase

Dr. Reddy's Laboratories Ltd. RDY reported fourth-quarter fiscal 2021 earnings of 46 cents per American Depositary Share ("ADS"), compared with 63 cents in the year-ago quarter.

However, revenues grew 7% year over year to $646 million.

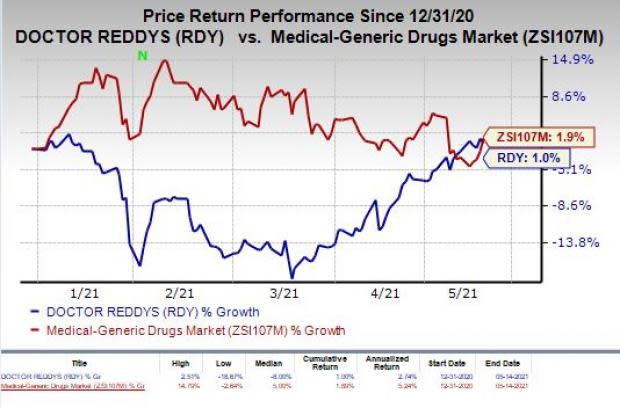

So far this year, shares of the company have risen 1% compared with the industry’s increase of 1.9%.

Quarter in Detail

Dr. Reddy’s reported revenues under three segments — Global Generics, Pharmaceutical Services & Active Ingredients (“PSAI”), and Proprietary Products and Others.

Global Generics revenues were INR 38.7 billion, up 6% year over year, in the fiscal fourth quarter. Growth was led by branded markets (India and emerging markets).

The company launched six products in North America, including Vigabatrin tablets (CGT status granted), Febuxostat tablets, Capecitabine tablets, Fluphenazine Hydrochloride tablets, Lansoprazole OD tablets andAbiraterone Acetate in Canada.

PSAI revenues were INR 7.9 billion, up 10% from the year-ago quarter.

Revenues in the Proprietary Products segment came in at INR 632 million, down 13% year over year.

Research and development expenses were down 2% year over year to $56 million. The company is undertaking the development of products pertaining to COVID-19-related drugs.

Selling, general and administrative expenses were $195 million, up 17% year over year due to incremental costs post the integration of the acquired divisions from Wockhardt and increased freight expenses.

As of Dec 31, cumulatively, 95 generic filings were pending approval from the FDA (92 abbreviated New Drug Applications [ANDAs] and three new drug applications). Of these 95 ANDAs, 47 are Para IVs and 23 have first-to-file status.

Fiscal 2021 Results

The company reported fiscal 2021 earnings of $1.57 per ADS, down from $1.61 in fiscal 2020.

Revenues increased 9% year over year to $2.6 billion.

Our Take

In fourth-quarter fiscal 2021, Dr. Reddy’s top line registered year-over-year growth while the bottom line declined year over year.

However, the company continues to face price erosion in the North America generics market, which will adversely impact sales.

Dr. Reddys Laboratories Ltd Price, Consensus and EPS Surprise

Dr. Reddys Laboratories Ltd price-consensus-eps-surprise-chart | Dr. Reddys Laboratories Ltd Quote

Zacks Rank & Stocks to Consider

Dr. Reddy’s currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the healthcare sector include Adverum Biotechnologies, Inc. ADVM, Adaptive Biotechnologies Corp. ADPT and Milestone Pharmaceuticals Inc. MIST, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Adverum Biotechnologies’ loss per share estimates have narrowed 10.3% for 2021 and 18% for 2022 over the past 60 days.

Adaptive Biotechnologies’ loss per share estimates have narrowed 11.7% for 2021 and 2.3% for 2022 over the past 60 days.

Milestone Pharmaceuticals’ loss per share estimates have narrowed 20.3% for 2021 and 16.1% for 2022 over the past 60 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research SherazMian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dr. Reddys Laboratories Ltd (RDY) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

Adverum Biotechnologies, Inc. (ADVM) : Free Stock Analysis Report

Milestone Pharmaceuticals Inc. (MIST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research