Is Draper Esprit plc (AIM:GROW) On The Right Side Of Disruption?

Draper Esprit plc (AIM:GROW), a GBP£225.32M small-cap, is a capital market firm operating in an industry, which has recently been facing serious existential threats resulting from potential disintermediation and disruption from new technology. Many aspects of banking and capital markets are being attacked by new competitors, whose key advantage is a leaner and technology-enabled operating model, allowing them to scale at a faster rate and meet changing consumer needs. Financial services analysts are forecasting for the entire industry, a fairly unexciting growth rate of 9 percent in the upcoming year, and a massive growth of 41 percent over the next couple of years. However this rate still came in below the growth rate of the UK stock market as a whole. Should your portfolio be overweight in the capital markets sector at the moment? Below, I will examine the sector growth prospects, and also determine whether GROW is a laggard or leader relative to its financial sector peers. See our latest analysis for GROW

What’s the catalyst for GROW's sector growth?

The threat of disintermediation in the capital markets industry is both real and imminent, taking profits away from traditional incumbent financial institutions. In the previous year, the industry endured negative growth of -558 percent, underperforming the UK market growth of 451 percent. GROW leads the pack with its impressive earnings growth of over 100 percent last year. However, analysts are not expecting this industry-beating trend to continue, with future growth expected to be -69 percent compared to the wider capital markets sector growth hovering of 9 percent, next year. As a future industry laggard in growth, GROW may be a cheaper stock relative to its peers.

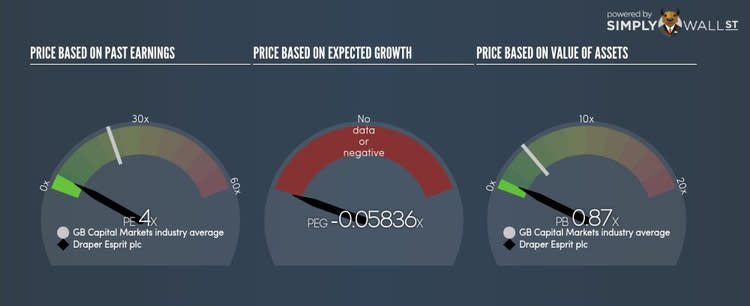

Is GROW and the sector relatively cheap?

Capital markets companies are typically trading at a PE of 22 times, below the broader UK stock market PE of 30 times. This illustrates a somewhat under-priced sector compared to the rest of the market. Furthermore, the industry returned a higher 21 percent compared to the market’s 19 percent, making it a potentially attractive sector. On the stock-level, GROW is trading at a lower PE ratio of 4 times, making it cheaper than the average capital markets stock. In terms of returns, GROW generated 44 percent in the past year, which is 23 percent over the capital markets sector.

What this means for you:

Are you a shareholder? GROW is a capital markets industry laggard in terms of its future growth outlook. This is possibly reflected in the PE ratio, with the stock trading below its peers. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto GROW as part of your portfolio, or maybe increase your holding. If you’re bearish on the stock, now may not be the best time to sell!

Are you a potential investor? If GROW has been on your watchlist for a while, now may be the time to dig deeper into the stock. Although the market is expecting lower growth for the company relative to its peers, GROW is also trading at a discount, meaning that there could be some value from a potential mispricing. However, before you make a decision on the stock, I suggest you look at GROW’s other important fundamentals such as the company’s financial health in order to build a holistic investment thesis.

For a deeper dive into Draper Esprit's stock, take a look at the company's latest free analysis report to find out more on its financial health and other fundamentals. Interested in other financial stocks instead? Use our free playform to see my list of over 600 other financial companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.