Dril-Quip (DRQ) Stock Gains 14.3% Despite Q4 Earnings Miss

Dril-Quip Inc. DRQ shares have jumped 14.3% despite reporting weak fourth-quarter 2021 results on Feb 23. It seems that the manufacturer of highly engineered drilling and production equipment expects an improvement in the business scenario in the near future.

The company reported a fourth-quarter 2021 adjusted loss per share of 46 cents, wider than the Zacks Consensus Estimate of a loss of 14 cents. The bottom line deteriorated from the year-ago loss of 12 cents per share.

It registered total revenues of $78 million for the quarter, lower than $87 million in the year-ago period. The top line also missed the Zacks Consensus Estimate of $93 million.

The weak quarterly results were caused by a decline in product revenues as a result of lower subsea product volumes in the Western Hemisphere and downhole tool product revenues in the Middle East.

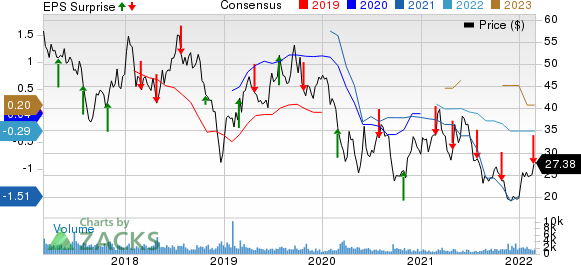

DrilQuip, Inc. Price, Consensus and EPS Surprise

DrilQuip, Inc. price-consensus-eps-surprise-chart | DrilQuip, Inc. Quote

Fourth-Quarter Performance

Dril-Quip reported product bookings of $79.8 million for the quarter. At the quarter-end, it had $210.1 million in backlog.

The company reported a fourth-quarter operating loss of $71.7 million, wider than a loss of $11.6 million in the prior-year period.

Total Costs and Expenses

On the cost front, the cost of sales declined to $61.2 million for the reported quarter from $64.1 million in the year-ago period. Engineering and product development costs contracted to $3.8 million for the quarter from the year-ago figure of $4 million. SG&A costs, however, bumped up to $30.6 million from $26.2 million a year ago.

Total cost and expenses for the quarter were $149.6 million compared with $99 million a year ago.

Free Cash Flow

Dril-Quip’s free cash flow for the fourth quarter was $2.6 million against a deficit of $18.5 million a year ago.

Financials

The company recorded $2.1 million in capital expenditure for the quarter versus the year-ago level of $1.7 million.

As of Dec 31, 2021, its cash balance was $355.5 million. It had total available liquidity of $384.4 million. The company’s balance sheet is free of debt load, which highlights a sound financial position.

Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Callon Petroleum Company CPE reported fourth-quarter adjusted earnings of $2.66 per share, missing the Zacks Consensus Estimate of $2.81. CPE currently has a Zacks Style Score of A for both Value and Growth.

Callon is expected to see earnings growth of 58% in 2022. As of Dec 31, 2021, CPE’s total cash and cash equivalents amounted to $9.9 million, increasing from $3.7 million at the third-quarter end.

Sunoco LP SUN reported fourth-quarter earnings of 95 cents per unit, missing the Zacks Consensus Estimate of $1.14. SUN currently has a Zacks Style Score of A for Value.

Sunoco is expected to see sales growth of 17.7% in 2022. As of Dec 31, 2021, SUN had cash and cash equivalents of $25 million, sequentially down from $88 million.

Antero Resources Corporation AR reported fourth-quarter 2021 adjusted earnings per share of 46 cents, missing the Zacks Consensus Estimate of 64 cents. AR currently has a Zacks Style Score of A for Value, Growth and Momentum.

Antero Resources is expected to see earnings growth of 150.7% in 2022. As of Dec 31, 2021, AR had no cash and cash equivalents. The company witnessed upward estimate revisions in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DrilQuip, Inc. (DRQ) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Callon Petroleum Company (CPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research