After Drug Failure, Genfit's Cupboard Is Nearly Bare

Genfit's (NASDAQ:GNFT) loss may be a gain for other companies developing a treatment for one of the most rapidly growing health problems around the world, particularly Intercept Pharmaceuticals Inc. (NASDAQ:ICPT).

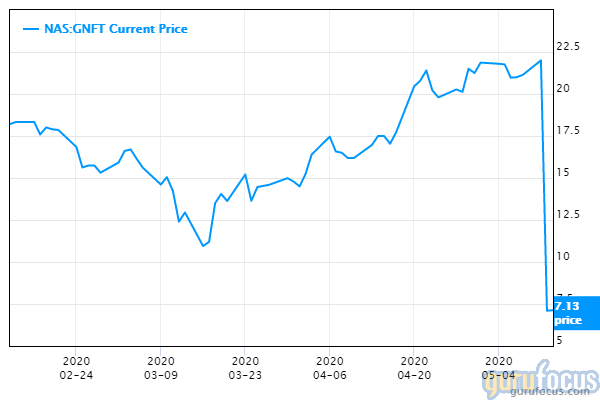

Shares of Lille, France-based Genfit plunged about 70% this week as the company reported that in a phase 3 trial, its drug to treat nonalcoholic steatohepatitis failed to meet study goals. The company said it would work with regulators to determine the next steps regarding continuation of the trial, according to an article in Feedspot.

Genfit's elafibranor was one of the two most highly touted NASH drugs. Now moving to the head of the pack is Intercept's obeticholic acid, which is expected to be reviewed by the U.S. Food and Drug Administration next month. NASH has proved to be a huge challenge. Last year, Gilead Science Inc.'s (NASDAQ:GILD) candidate also failed in a phase 3 study. Other companies with drugs that missed the mark are Boehringer Ingelheim and Pharmaxis Ltd. (PXSLY).

Intercept's stock spiked about 10% from the beginning of the week, hitting about $95, but has since retreateed to about $83. Perhaps investors came to their senses after surveying the NASH graveyard and concluding that developing a drug to treat the condition might be a bigger challenge than initially thought.

NASH is the buildup of fat in the liver that's predominantly caused by obesity rather than alcohol misuse. A drug to treat the disease is sorely needed, but hepatologist Tarek Hassanein, M.D., said an effective option already exists, according to an article in FierceBiotech.

"When someone says we don't have anything to manage NASH--no, we have the key thing, which is lifestyle modification," said Hassanein, a professor of medicine and director of outreach services for liver transplantation at the University of California San Diego School of Medicine.

Developing an effective NASH drug and getting it approved would be only the first step for any pharma company. The next would be getting the treatment to everyone it could help. That's because NASH symptoms usually don't show up until the disease has progressed.

Genfit is hoping to salvage some of its NASH efforts by working on a test that would pinpoint patients who are likely to have the disease get worse. Of course, a test would be far less lucrative than a drug to treat the condition.

The size of the NASH opportunity is huge. According to iHealthcareAnalyst, the global market treatment is estimated to reach more than $37 billion in 2027, growing at a compounded annual rate of nearly 10% during the forecast period. That estimate appears to be overly optimistic in view of the fact that it's based on approval of four drugs to treat the condition, one of which is Genfit's.

With the failure of its NASH drug, Genfit doesn't have much left in the cupboard. It's developing elafibranor for another liver disease, the market for which is tiny compared to NASH. In addition, the company said it is considering picking up other assets to fill the void left by its NASH program

Others developing NASH drugs include Madrigal Pharmaceuticals Inc. (NASDAQ:MDGL), Allergan (NYSE:AGN), Galmed Pharmaceuticals Ltd. (NASDAQ:GLMD), TaiwanJ Pharmaceuticals (ROCO:6549) and privately held Cirius Therapeutics.

Disclosure: The author holds a position in Gilead Sciences.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.