DSP Group (NASDAQ:DSPG) Shareholders Booked A 56% Gain In The Last Five Years

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the DSP Group, Inc. (NASDAQ:DSPG) share price is up 56% in the last five years, that's less than the market return. Zooming in, the stock is up just 3.8% in the last year.

View our latest analysis for DSP Group

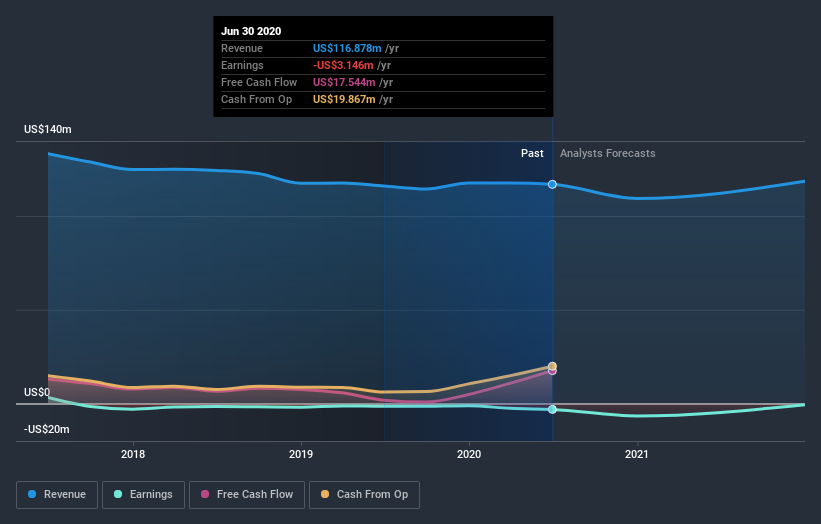

DSP Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade DSP Group's revenue has actually been trending down at about 5.2% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 9% per year over that time. That's pretty decent given the top line decline, and lack of profits. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at DSP Group's financial health with this free report on its balance sheet.

A Different Perspective

DSP Group shareholders are up 3.8% for the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 9% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand DSP Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for DSP Group you should know about.

Of course DSP Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.