Earnings begin — What you need to know in markets this week

After a June jobs report that topped expectations, markets will turn their focus this week to the beginning of second quarter earnings season.

Financial stocks will be the focus this week, with Friday morning expected to be jam-packed as results from PNC (PNC), JP Morgan (JPM), Citi (C), and Wells Fargo (WFC) all expected out.

Elsewhere in earnings this week markets will get results from Pepsi (PEP) on Tuesday and Delta Air Lines (DAL) on Thursday.

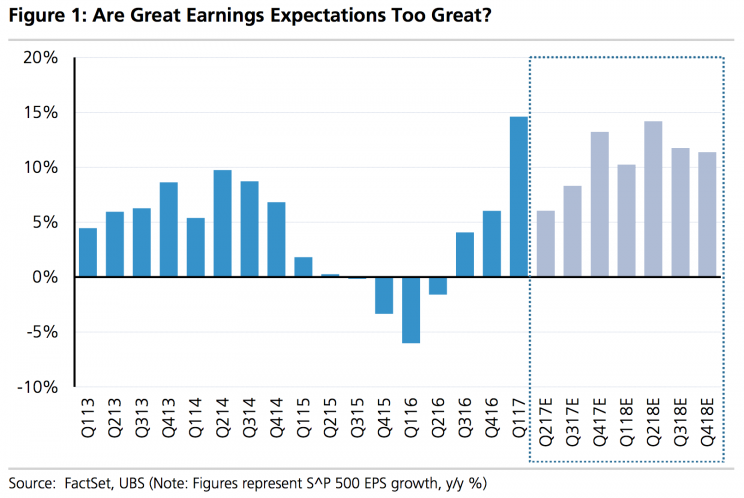

Right now, Wall Street analysts expect earnings for the S&P 500 to rise 6.5% in the second quarter, and according to FactSet expectations for the second quarter have been cut by the least since 2014. Additionally, FactSet notes that S&P 500 companies have exceeded actual estimated earnings by 4.2%.

Julian Emanuel, strategist at UBS, notes that with expectations so high for the financial sector — which has taken up a leadership role in the market amid weakness in big-cap tech names — better-than-expected earnings may not be enough to drive the sector.

Emanuel adds that price action from big financial stocks as well as the “FAAMG” tech stocks which have powered the market “will hold the key for whether the current ‘Summer Squall’ in Tech will continue to pressure the broad market.”

On the economic data side, we’ll get a check on consumer spending with retail sales, a check on inflation, and an update on job openings in the U.S. during the week.

Economic calendar

Monday: Labor market conditions index, June (2.3 previously); Consumer credit, May ($13.35 billion expected; $8.2 billion previously)

Tuesday: NFIB small business optimism, June (104.4 expected; 104.5 previously); Job openings and labor turnover survey, May (6.044 million previously)

Wednesday: Federal Reserve Beige Book

Thursday: Producer prices, June (+0% expected; 0% previously); Initial jobless claims (245,000 expected; 248,000 previously)

Friday: Consumer prices, June (+0.1% expected; -0.1% previously); “Core” consumer prices year-on-year, June (+1.7% expected; +1.7% previously); Retail sales, June (+0.2% expected; -0.3% previously); Industrial production, June (+0.3% expected; 0% previously); University of Michigan consumer sentiment, preliminary July (95 expected; 95.1 previously); Business inventories, May (+0.3% expected; -0.2% previously)

Jobs reaction

Overall, Friday’s jobs report was a relative non-event.

Markets rallied after the report, but given the decline we saw in markets on Thursday and the rise in bond yields we saw on Friday, a straight line can’t be drawn from the numbers and what happened in financial markets during the day.

The most notable bit of news to emerge from the report was average hourly earnings, which rose 2.5% over last year, less-than-expected and an indication that the inflationary pressures are not popping up across the economy en masse.

For those arguing that the Federal Reserve will make an error if it raises rates again this year, the wage data in June provided additional fodder. Or as Michael Gapen, an economist at Barclays writes, “This report will do little to assuage market fears that the Fed may be making a policy mistake in terms of its inflation mandate as the combination of solid employment and modest wage gains has been the case for some time.”

Jim O’Sullivan, chief U.S. economist at High Frequency Economics, wrote Friday that, “for now, the wage data are tame enough to keep the debate about the relationship between [labor market slack] and inflation very much alive.”

The 222,000 jobs added to the economy in June coupled with the rise in the unemployment rate to 4.4% amid an increase in participation do show that there are still folks outside the workforce who can and will take jobs. This is the “slack” that economists refer to. When this slack is all gone — or really stressing the market — the thinking is that wages will take off more aggressively.

The continued strength in payroll gains and weaker wage figures, however, are not all necessarily pointing to a labor market that is still soft or a Fed about to inevitably make a mistake by raising interest rates again (or tightening financial conditions by shrinking its balance sheet).

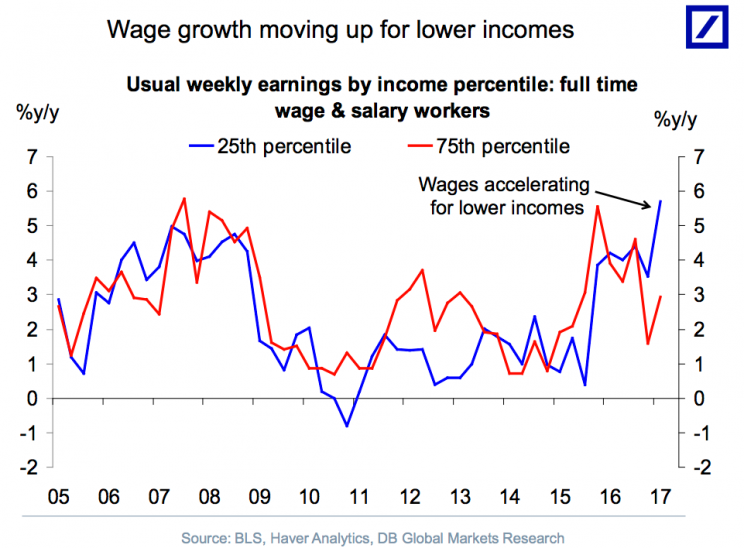

Torsten Sløk, an economist at Deutsche Bank, circulated the following chart on Friday, showing that wage gains have been concentrated among folks in the lowest quartile of earners.

This is a positive development for the economy as those with the lowest incomes will see the biggest benefits from increases in wages and likely have what economists call a higher marginal propensity to consume.

Others like Rick Rieder, chief investment officer of global fixed income at BlackRock (BLK), see the lack of acceleration in wages as being owed to a few factors.

“We have previously shown that there are very good reasons why the normal Phillips curve reaction to low unemployment is likely to lag in this economic cycle, with an ultimately lower reaction function than historically has been witnessed,” Rider writes. (The Phillips curve says that when the unemployment rate falls to a certain level inflation accelerates.)

“Some of the factors accounting for this difference are: just-in-time hiring, technology-driven job efficiencies, a lower goods-producing (high wage) workforce, and a rapid growth of temporary hiring (which is to say, more permanently temporary employees),” Rieder adds.

Rieder has also been among those who argue that inflation, and overall economic growth, are understated by the way we measure things like technology and the impacts that, say, smartphones have on productivity both at the personal and corporate level.

Additionally, Rieder argues that when it comes to which central bank matters most for markets, it is European Central Bank and the Bank of Japan which matter more for investors than the Fed. Less accommodation not just from the Fed but from central banks around the world, then, is the theme to watch.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: