Earnings Estimates Come Under Pressure Outside of Energy

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

For the 177 S&P 500 companies that have reported Q1 results, total earnings are up +1.1% on +11.4% higher revenues, with 80.8% beating EPS estimates, 72.9% beating revenue estimates and 62.7% beating both estimates.

The Q1 EPS and revenue beats percentages are at the lowest level since the second quarter of 2020 for this group of 177 index members.

Looking at Q1 as a whole, total S&P 500 earnings for the period are expected to be up +6.6% from the same period last year on +11.1% higher revenues. Earnings growth for the quarter drops to +0.5% on an ex-Energy basis, but improves to +13.3% on an ex-Finance basis.

While the Q1 earnings season has been fairly good and reassuring in most respects, we have nevertheless been struck by major companies’ inability to beat consensus estimates.

The punishment inflicted on Netflix NFLX may have been one of a kind, but we have since seen many others getting punished for coming up short, though none to the same extent as the streaming giant. General Electric GE, HCA Holdings HCA and a number of others fall in that category.

You can see this in the EPS and revenue beats percentages for the 177 S&P 500 members that have reported Q1 results already.

Image Source: Zacks Investment Research

This is likely reflective of the collective inability of management teams and analysts to fully grasp the impact of inflation and logistical bottlenecks. We have already seen plenty of references to these headwinds from the companies that have reported Q1 results so far.

Looking at Q1 as a whole, total S&P 500 earnings are expected to be up +6.6% on +11.1% higher revenues. This is a significant deceleration from what we have been seeing in the preceding quarters, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Looking at the revisions trend in the aggregate, estimates are still going up, though only modestly so. You can see this in the chart below that plots the aggregate earnings for the index have evolved since the start of the year.

Image Source: Zacks Investment Research

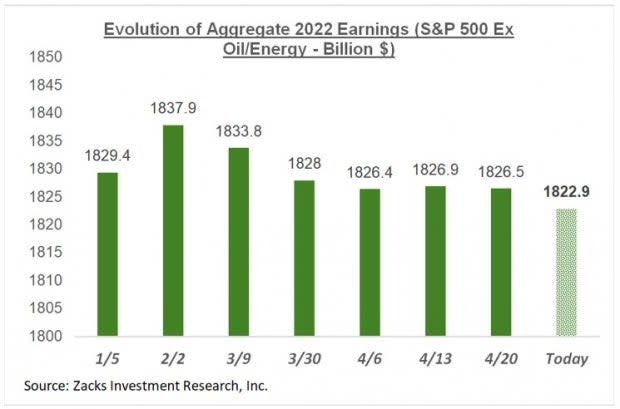

There are plenty of cross currents once we look at the revisions trend at the granular level, with rising estimates in a few sectors offsetting estimate cuts in others. The chart below reproduces the above chart, but excludes the Energy sector estimates. As you can see, the aggregate total outside of the Energy sector have been modestly trending down.

Image Source: Zacks Investment Research

Energy sector estimates had been going up as a result of rising oil prices, even before the Ukraine situation and we can see this within all of the major players in the sector. The significant estimate cuts to the Transportation sector, like air carriers and truckers, represent the flip side of what’s happening to the Energy sector estimates.

There is a rising degree of uncertainty about the outlook, being driven by a lack of macroeconomic visibility as reflected in the Treasury yield curve that is at risk of inversion.

The Ukraine situation appears to be exacerbating pre-existing supply-chain issues, which combined with its impact on oil prices, is weighing on the inflation situation in hard-to-predict ways. The evolving earnings revisions trend will reflect this macro backdrop.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research