Earnings Estimates Have Stopped Going Up

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

We know that the earnings picture remains strong, even though the growth pace is expected to decelerate significantly in Q3 and beyond. What we don’t know at this stage is whether the incremental change in the earnings outlook over the coming days, as reflected in earnings estimate revisions, will be positive or negative.

Estimates for 2021 Q3, whose early reports have started coming out, have not moved up as much as had been the case in the comparable periods in the last few quarters. That said, the revisions trend remains positive and could very well gain steam as the reporting cycle gets underway.

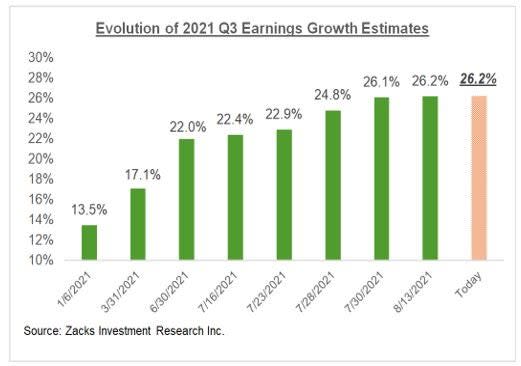

Total Q3 earnings for the S&P 500 index are expected to be up +26.2% from the same period last year on +13.7% higher revenues. This would follow the +94.9% earnings growth on +25.2% higher revenues in Q2.

Notable features of the last earnings season (2021 Q2) included broad-based strength, with the aggregate quarterly earnings total reaching a new all-time record, impressive momentum on the revenue side and continued positive estimate revisions for the current period (2021 Q3) and beyond, albeit at a decelerated pace.

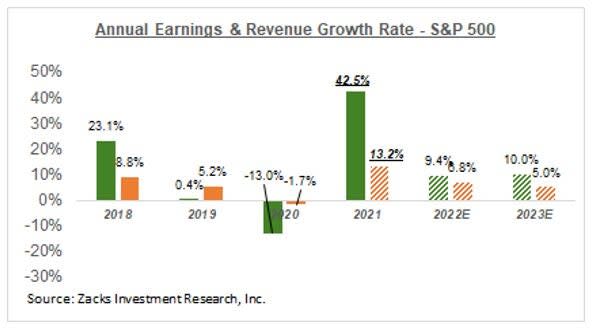

Looking at the calendar-year picture for the S&P 500 index, earnings are projected to climb +42.5% on +13.2% higher revenues in 2021 and increase +9.0% on +6.8% higher revenues in 2022. This would follow the -13% earnings decline on -1.7% lower revenues in 2020.

For the small-cap S&P 600 index, total Q3 earnings are expected to be up +43.6% on +15.8% higher revenues, which would follow the +268.7% earnings growth on +30.6% higher revenues in 2021 Q2.

The implied ‘EPS’ for the S&P 500 index, calculated using the current 2021 P/E of 22.9X and index close, as of September 14th, is $193.70, up from $135.90 in 2020. Using the same methodology, the index ‘EPS’ works out to $212.0 for 2022 (P/E of 21.0X). The multiples have been calculated using the index’s total market cap and aggregate bottom-up earnings for each year.

The Q3 earnings season will really get underway when JPMorgan JPM and other major banks come out with their quarterly results on October 13th. That’s when everyone starts paying attention to the earnings season. But the reporting cycle actually gets underway much earlier, with this week’s quarterly report from Oracle ORCL kickstarting the earnings season. Just like Oracle, we have other major players like FedEx FDX, Nike NKE and others on deck to report quarterly results in the coming days for their respective fiscal quarters ending in August.

All such August-period results will get included with the September-quarter reports as part of the Q3 reporting cycle. We will have seen roughly two dozen such August period results by the time JPMorgan comes out with its quarterly results.

Total Q3 earnings for the S&P 500 index are expected to be up +26.2% from the same period last year on +13.7% higher revenues. This would follow the +94.9% earnings growth on +25.2% higher revenues in Q2.

The chart below shows how Q3 estimates have evolved since the start of the year.

Image Source: Zacks Investment Research

Please note that while the Q3 estimate revisions trend remains positive, it is not as strong as we had seen in the comparable periods of the preceding two quarters. It might be nothing more than a reflection of analysts’ tentativeness about the impact of the ongoing Delta variant, but it is nevertheless something we will be closely monitoring in the days ahead.

The chart below provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the full-year 2021 growth picture steadily improving, with the revisions trend accelerating in the back half of the year.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

NIKE, Inc. (NKE): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

FedEx Corporation (FDX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research