Earnings Miss: Arko Corp. Missed EPS By 29% And Analysts Are Revising Their Forecasts

Arko Corp. (NASDAQ:ARKO) missed earnings with its latest annual results, disappointing overly-optimistic forecasters. Unfortunately, Arko delivered a serious earnings miss. Revenues of US$3.3b were 20% below expectations, and statutory earnings per share of US$0.14 missed estimates by 29%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for Arko

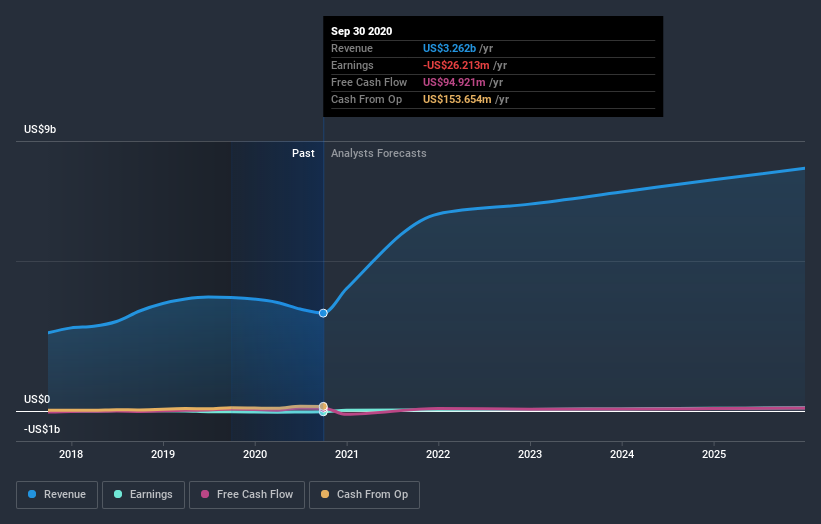

After the latest results, the three analysts covering Arko are now predicting revenues of US$6.57b in 2021. If met, this would reflect a huge 101% improvement in sales compared to the last 12 months. Arko is also expected to turn profitable, with statutory earnings of US$0.27 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$6.36b and earnings per share (EPS) of US$0.31 in 2021. While next year's revenue estimates increased, there was also a substantial drop in EPS expectations, suggesting the consensus has a bit of a mixed view of these results.

The analysts also cut Arko's price target 5.1% to US$12.33, implying that lower forecast earnings are expected to have a more negative impact than can be offset by the increase in sales. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Arko analyst has a price target of US$13.00 per share, while the most pessimistic values it at US$12.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Arko's rate of growth is expected to accelerate meaningfully, with the forecast 101% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 16% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Arko to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Arko. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Arko. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Arko analysts - going out to 2025, and you can see them free on our platform here.

You can also view our analysis of Arko's balance sheet, and whether we think Arko is carrying too much debt, for free on our platform here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.