Earnings Release: Here's Why Analysts Cut Their Hurricane Energy plc (LON:HUR) Price Target To UK£0.019

It's been a sad week for Hurricane Energy plc (LON:HUR), who've watched their investment drop 13% to UK£0.011 in the week since the company reported its annual result. It was a pretty bad result overall; while revenues were in line with expectations at US$180m, statutory losses exploded to US$0.30 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Hurricane Energy

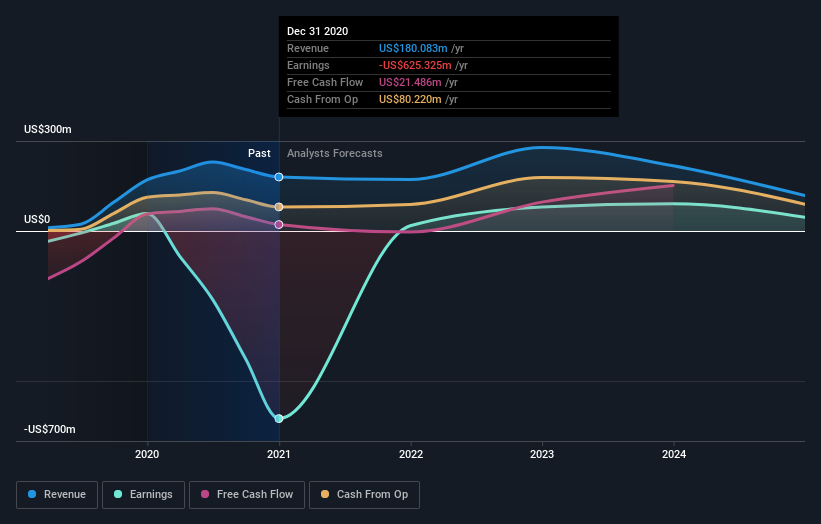

Taking into account the latest results, the three analysts covering Hurricane Energy provided consensus estimates of US$171.4m revenue in 2021, which would reflect a small 4.8% decline on its sales over the past 12 months. Earnings are expected to improve, with Hurricane Energy forecast to report a statutory profit of US$0.005 per share. In the lead-up to this report, the analysts had been modelling revenues of US$197.1m and earnings per share (EPS) of US$0.003 in 2021. There's been a definite change in sentiment after these results, with the analysts delivering a a small to next year's revenue estimates, while at the same time substantially upgrading EPS. It's almost as though the business is anticipated to reduce its focus on growth to enhance profitability.

The analysts have cut their price target 42% to UK£0.019per share, suggesting that the declining revenue was a more crucial indicator than the expected improvement in earnings. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Hurricane Energy analyst has a price target of UK£0.03 per share, while the most pessimistic values it at UK£0.008. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 4.8% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 5.6% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.6% annually for the foreseeable future. It's pretty clear that Hurricane Energy's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Hurricane Energy's earnings potential next year. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. With that said, earnings are more important to the long-term value of the business. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Hurricane Energy going out to 2024, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hurricane Energy , and understanding these should be part of your investment process.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.