East West Bancorp (EWBC) Beats on Q3 Earnings, Ups Loan Target

East West Bancorp’s EWBC third-quarter 2021 earnings per share of $1.57 outpaced the Zacks Consensus Estimate of $1.50. The bottom line jumped 40.2% from the prior-year quarter’s 70 cents.

Results reflect higher revenues and negative provisions. The company witnessed a rise in loan and deposits balance during the quarter. However, lower interest rates and a rise in operating expenses were the undermining factors.

Net income was $225.4 million, surging 41.3% from the year-ago quarter.

Revenues & Expenses Up

Net revenues were $468.8 million, rising 23.8% year over year. The top line beat the Zacks Consensus Estimate of $456.6 million.

Net interest income was $395.7 million, growing 22.1%. Net interest margin contracted 2 basis points (bps) to 2.70%.

Non-interest income was $73.1 million, increasing 34.1%. The improvement largely resulted from higher deposit account fees, foreign exchange income, and wealth management fees.

Non-interest expenses were up 19% to $205.4 million. The increase was mainly due to a rise in all components except occupancy and equipment expense, data processing expense, and computer software expense.

Efficiency ratio was 43.81%, down from 45.85% recorded in the prior-year quarter. A fall in the efficiency ratio indicates an improvement in profitability.

As of Sep 30, 2021, net loans were $39.9 billion, up 1.1% sequentially. Total deposits increased 1.5% to $53.4 billion.

Credit Quality Improves

Annualized quarterly net charge-offs were 0.13% of average loans held for investment, down 13 bps year over year. Provision for credit losses was negative $10 million against a provision of $10 million in the prior-year quarter.

As of Sep 30, 2021, non-performing assets were $172.6 million, decreasing 33.6%.

Strong Capital & Profitability Ratios

As of Sep 30, 2021, common equity Tier 1 capital ratio was 12.8%, in line with the Sep 30, 2020 level. Total risk-based capital ratio was 14.2%, down from 14.5%.

At the end of the third quarter, return on average assets was 1.46%, up from 1.26% as of Sep 30, 2020. As of Sep 30, 2021, return on average tangible equity was 17.25%, up from 13.88%.

2021 Outlook

Management assumes no change in interest rates. Loans are now expected to grow 10-11% (up from the previously mentioned range of 9-10% growth), on the back of a strong pipeline.

Adjusted NII (excluding paycheck protection program income) is now expected to increase 10-11%.

Adjusted non-interest expenses (excluding tax credit investment & core deposit intangible amortization) are projected to rise 5%.

Management expects to book to record negative provision of roughly $10 million for the fourth quarter, based on current macroeconomic forecast and loan growth outlook. This is a change from no provision for credit losses as expected earlier.

Effective tax rate is expected to be 17%, including the impacts of tax credit investments. The company anticipates fourth-quarter 2021 amortization of tax credit & other investments of nearly $30 million.

Our View

East West Bancorp is well poised for organic growth on continued improvement in loan and deposit balances, and efforts to improve fee income. However, pressure on margins and rising operating costs are near-term concerns.

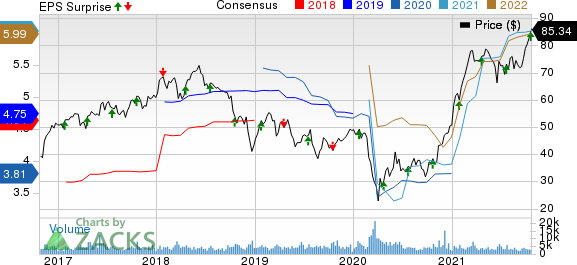

East West Bancorp, Inc. Price, Consensus and EPS Surprise

East West Bancorp, Inc. price-consensus-eps-surprise-chart | East West Bancorp, Inc. Quote

Currently, East West Bancorp carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Hancock Whitney Corporation’s HWC third-quarter 2021 adjusted earnings of $1.45 per share outpaced the Zacks Consensus Estimate of $1.29. The bottom line improved 61.1% from the prior-year quarter.

Commerce Bancshares Inc.’s CBSH third-quarter 2021 earnings per share of $1.05 surpassed the Zacks Consensus Estimate of $1.00. The bottom line, however, declined almost 1% from the prior-year quarter.

Zions Bancorporation’s ZION third-quarter 2021 net earnings per share of $1.45 surpassed the Zacks Consensus Estimate of $1.38. The bottom line represents an increase of 43.6% from the year-ago quarter’s number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research