Eastman Chemical (EMN) Stock Up 26% in 6 Months: Here's Why

Eastman Chemical Company’s EMN shares have popped 25.7% over the past six months. The company has also topped its industry’s rise of 14.9% over the same time frame.

The chemical maker has a market cap of roughly $10.4 billion and average volume of shares traded in the last three months is around 1,029.1K.

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) stock.

What’s Favoring the Stock?

Eastman Chemical is gaining from its innovation-driven growth model, cost-management actions and acquisitions.

The company is taking an aggressive approach to cost management in response to the coronavirus pandemic. It has significantly increased its cost-reduction target, which is forecast to be roughly $150 million of net savings in 2020. These cost actions include reduction of discretionary spending. The company’s cost reduction actions are expected to contribute to its earnings per share in 2020.

Moreover, Eastman Chemical is focused on growing new business revenues from innovation. In particular, the company’s Advanced Materials unit has a number of products that are driving new business revenues.

Eastman Chemical is also benefiting from synergies of acquisitions. The acquisition of Marlotherm heat transfer fluids manufacturing assets in Germany has allowed the company to boost its heat transfer fluids product offerings to customers globally. Moreover, the acquisition of Spain-based cellulosic yarn producer, INACSA reinforces the growth of the company’s textiles innovation products like Naia cellulosic yarn.

The company also remains committed to maintain a disciplined approach to capital allocation, with an emphasis on financing its dividend and debt reduction. It expects to reduce net debt by more than $600 million in 2020. The company is also taking actions to boost its cash flows. These include reduction of capital expenditure. It expects to generate more than $1 billion of free cash flow this year.

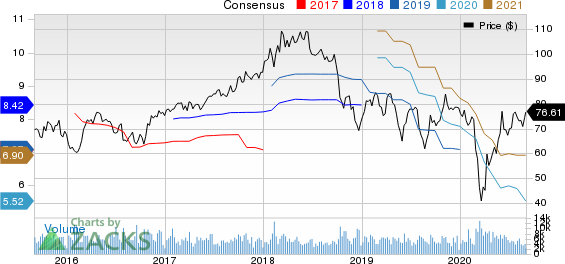

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Barrick Gold Corporation GOLD, Yamana Gold Inc. AUY and Eldorado Gold Corporation EGO.

Barrick Gold has a projected earnings growth rate of 80.4% for the current year. The company’s shares have gained around 51% in a year. It currently has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Yamana Gold has a projected earnings growth rate of 76.9% for the current year. The company’s shares have rallied roughly 66% in a year. It currently carries a Zacks Rank #2 (Buy).

Eldorado Gold has an expected earnings growth rate of 2,325% for the current year. The company’s shares have gained around 20% in the past year. It presently carries a Zacks Rank #2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Yamana Gold Inc. (AUY) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research