Eastman Chemical (EMN) Stock Rallies 38% in 6 Months: Here's Why

Eastman Chemical Company’s EMN shares have popped 37.9% over the past six months. The chemical maker has also outperformed its industry’s rise of 28.7% over the same time frame. Moreover, it has topped the S&P 500’s 21.7% rise over the same period.

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) stock.

What’s Going in EMN’s Favor?

Solid fourth-quarter earnings performance and upbeat prospects have contributed to the rally in Eastman Chemical’s shares. Its adjusted earnings of $1.69 per share for the fourth quarter topped the Zacks Consensus Estimate of $1.53. Revenues of $2,186 million also beat the Zacks Consensus Estimate of $2,142 million. The company gained from its innovation-driven growth model, cost-management actions and improved demand across its end markets from the coronavirus-led slowdown.

Eastman Chemical, on its fourth-quarter call, said that it expects adjusted earnings per share for 2021 to be 20-30% higher than the 2020 level.

Earnings estimates for Eastman Chemical have also been going up over the past two months. The Zacks Consensus Estimate for 2021 has increased around 7.4% while the same for first-quarter 2021 has gone up 12.7%. The favorable estimate revisions instill investor confidence in the stock.

Eastman Chemical is seeing a recovery across building & construction, automotive and consumer durables markets. Continued recovery in these markets is expected to drive its sales volumes in 2021. The company also remains focused on growing new business revenues from innovation.

Moreover, the company is taking an aggressive approach to cost management in the wake of the pandemic. These initiatives include reduction of discretionary spending. The company reduced costs by roughly $150 million in 2020. It is also on track with its cost-cutting actions in 2021, which are expected to contribute to its earnings per share.

Eastman Chemical also remains committed to maintaining a disciplined approach to capital allocation, with an emphasis on financing its dividend and debt reduction. The company returned $418 million to shareholders through share repurchases and dividends during 2020. It has also hiked its dividend for the 11th consecutive year. Moreover, the company reduced net debt by more than $600 million in 2020.

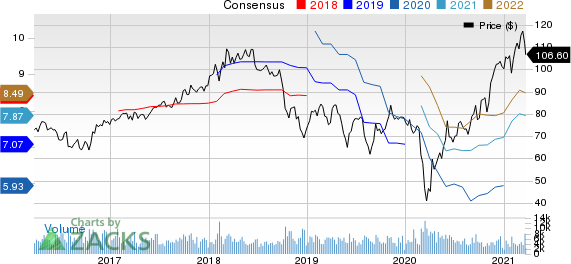

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Stocks to Consider

Better-ranked stocks in the basic materials space include Nucor Corporation NUE, Fortescue Metals Group Limited FSUGY and United States Steel Corporation X.

Nucor has a projected earnings growth rate of 122.5% for the current year. The company’s shares have surged around 116% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fortescue has a projected earnings growth rate of 107.8% for the current fiscal. The company’s shares have surged around 138% in a year. It currently sports a Zacks Rank #1.

U.S. Steel has an expected earnings growth rate of 201.1% for the current year. The company’s shares have surged around 238% in the past year. It currently carries a Zacks Rank #2 (Buy).

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Steel Corporation (X) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research