Eastman (EMN) to Buy Matrix, Boost Paint Protection Films

Eastman Chemical Company EMN recently announced that it will be acquiring the business and assets, including the extended line of automotive film patterns of Matrix Films, LLC, the marketer of Premium Shield performance films.

The buyout, expected to close in 2021, will broaden Eastman's paint protection film pattern development capabilities, pattern database, and expertise in installation. It will also add to its automotive base in North America, Europe, and the Middle East and boost its paint protection films and window films.

Eastman is enthusiastic about getting the scope of leveraging the experience of the Premium Shield team to jointly create growth synergies and strengthen its position as an industry leader in performance films.

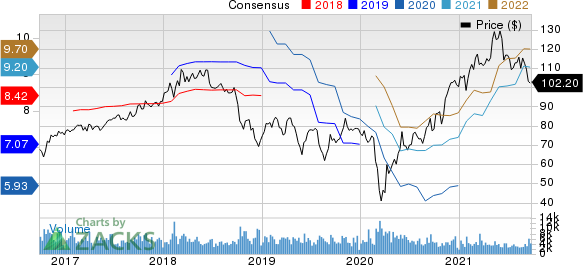

Shares of Eastman have rallied 33.5% in a year compared with the industry’s rise of 23.9%. The estimated earnings growth rate for the company for the current year is pegged at 50.1%.

Image Source: Zacks Investment Research

In the last quarter’s earnings call, Eastman said that it expects continued momentum as it gains from innovation, strong end-market recovery, and cost discipline from its operations transformation program. It expects adjusted earnings per share of $8.8-$9.2 for 2021. It also anticipates free cash flow to exceed $1.1 billion for the year, which would be the fifth consecutive year of a free cash flow above $1 billion.

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Zacks Rank & Stocks to Consider

Currently, Eastman carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Avient Corporation AVNT, Methanex Corporation MEOH, each flaunting a Zacks Rank #1 (Strong Buy), and The Chemours Company CC carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Avient has a projected earnings growth rate of 75.1% for the current year. The company’s shares have surged 73.9% in a year.

Methanex has a projected earnings growth rate of 422.8% for the current year. The company’s shares have climbed 91.5% in a year.

Chemours has a projected earnings growth rate of 86.4% for the current year. The company’s shares have rallied 38.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research