Eastman (EMN) to Expand in Dresden for Boosting Film Business

Eastman Chemical Company EMN recently announced a capacity expansion at its production facility in Dresden, Germany to support a new coating and laminating line for film. This investment is anticipated to support the strong growth momentum of the company’s high-performance branded paint protection and window film products.

Notably, the capacity extension will strengthen Eastman Chemical’s assets in Martinsville, VA and is expected to be online by the middle of 2021, creating about 50 new job opportunities at the site.

Per Eastman Chemical, the additional capacity will enable the company to meet an ongoing ramp-up of its paint protection films in Europe and around the globe. This strategic move will also provide impetus to address the increasing customer needs for high-value automotive and architectural window.

Eastman Chemical announced a string of important investments in paint protection films, such as a Performance Films Patterns and Software Center of Excellence, multiple expansions at its production hub in Martinsville plus Core pattern and business operations software.

Shares of Eastman Chemical have dipped 1.4% in the past year compared with the industry’s decline of 22.9%.

Eastman Chemical anticipates sales volume and capacity utilization to drop in the fourth quarter due to the worsening of the global business environment, resulting from trade uncertainties and other macro factors. Considering these factors, the company anticipates adjusted earnings per share of $7.00-$7.20 for full-year 2019.

Despite a difficult business landscape, Eastman Chemical deepens its focus on managing costs and generating new business revenues from innovation, especially in the Advanced Materials segment.

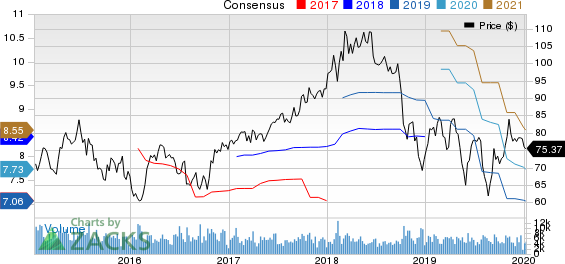

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Zacks Rank & Stocks to Consider

Eastman Chemical currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp. DQ, Pan American Silver Corp. PAAS and Sibanye Gold Limited SBGL.

Daqo New Energy has a projected earnings growth rate of 294.7% for 2020. The company’s shares have skyrocketed 107.2% in a year. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pan American Silver has an estimated earnings growth rate of 38.1% for 2020. It currently flaunts a Zacks Rank of 1. The stock has surged 47% in a year.

Sibanye Gold has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 587.5% for 2020. The stock has soared 227.6% in a year

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Sibanye Gold Limited (SBGL) : Free Stock Analysis Report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research