Easy Come, Easy Go: How Lite Access Technologies (CVE:LTE) Shareholders Got Unlucky And Saw 87% Of Their Cash Evaporate

Over the last month the Lite Access Technologies Inc. (CVE:LTE) has been much stronger than before, rebounding by 115%. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 87% in that time. So it sure is nice to see a big of an improvement. But the more important question is whether the underlying business can justify a higher price still.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Lite Access Technologies

Lite Access Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Lite Access Technologies saw its revenue grow by 9.7% per year, compound. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 49% per year is due to the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

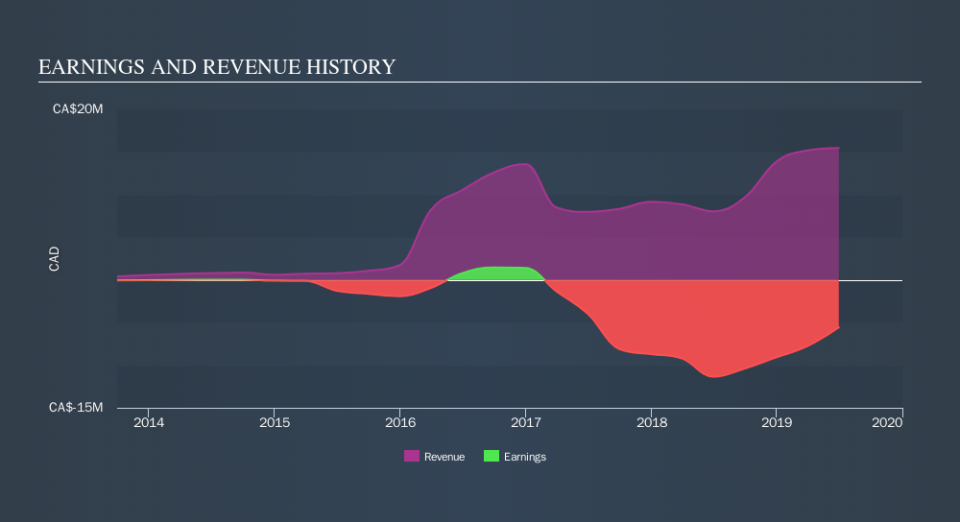

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for Lite Access Technologies shares, which cost holders 59%, while the market was up about 8.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 49% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Before spending more time on Lite Access Technologies it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.