Eaton Vance (EV) Q2 Earnings Beat, Costs Fall, Stock Down 3.1%

Eaton Vance Corp.’s EV second-quarter fiscal 2020 (ended Apr 30) adjusted earnings of 80 cents per share surpassed the Zacks Consensus Estimate of 71 cents. Including certain one-time items, earnings came in at 65 cents, down 27% year over year.

Results were driven by prudent expense management. However, fall in assets under management (AUM) balance and revenues were on the downside. This, perhaps, was the reason why the company’s shares declined 3.1% following the release.

Net income attributable to shareholders (GAAP basis) was $72.1 million, down 29.2% from the year-ago quarter.

Revenues Down, Expenses Fall

Total revenues in the reported quarter were $405.9 million, down 1% year over year. Fall in management fees was partially offset by higher performance fees. The top line also lagged the Zacks Consensus Estimate of $428.7 million.

Total expenses decreased marginally from the prior-year quarter to $284 million. Lower compensation and distribution expenses were partially muted by higher service fee expense, amortization of deferred sales commissions, fund-related expenses and other expenses.

Total operating income slid 4% year over year to $122 million.

Liquidity Position Strong, AUM Balance Declines

As of Apr 30, 2020, Eaton Vance had $914.9 million in cash and cash equivalents compared with $557.7 million on Oct 31, 2019. The company had no borrowings outstanding against its $300-million credit facility.

Eaton Vance’s consolidated AUM edged down 1% year over year to $465.3 billion as of Apr 30, 2020. The company recorded market price depreciation, partly offset by net inflows.

Share Repurchase Update

During the first six months of fiscal 2020, Eaton Vance repurchased and retired nearly 2.4 million shares of its Non-Voting Common Stock for $299.9 million under the company’s existing repurchase authorization.

As of Apr 30, 2020, nearly 4 million shares remained available under buyback authorization.

Our Take

Eaton Vance’s decreasing expenses might support its bottom line to quite an extent. However, a lower AUM balance and reduced revenues are likely to hamper growth in the quarters ahead.

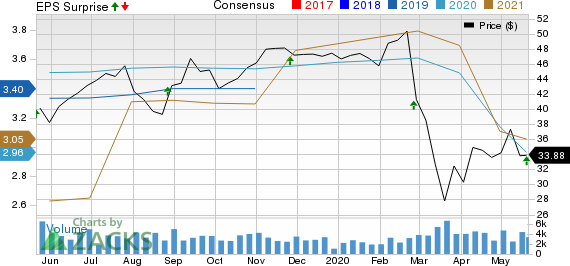

Eaton Vance Corporation Price, Consensus and EPS Surprise

Eaton Vance Corporation price-consensus-eps-surprise-chart | Eaton Vance Corporation Quote

Currently, Eaton Vance carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Stocks

Invesco IVZ reported first-quarter 2020 adjusted earnings of 34 cents per share, missing the Zacks Consensus Estimate of 56 cents. Also, the bottom line plummeted 39.3% from the prior-year quarter. Escalating operating expenses and net outflows were the major headwinds amid the coronavirus scare. Nevertheless, a rise in the AUM balance and higher revenues — driven by the OppenheimerFunds buyout — were the supporting factors.

Cohen & Steers’ CNS adjusted earnings of 61 cents per share missed the Zacks Consensus Estimate of 66 cents in the first quarter. However, the bottom line came in 5.2% higher than the year-ago reported figure. Rise in expenses and fall in AUM balance were the major headwinds. Yet, improvement in revenues and modest asset inflows offered some support.

T. Rowe Price TROW delivered first-quarter 2020 adjusted earnings per share of $1.87, which outpaced the Zacks Consensus Estimate of $1.85. The reported figure came in line with the year-ago quarter’s reported tally. Results were aided by higher revenues on solid growth in investment advisory fees. Nonetheless, escalating expenses were an undermining factor. Also, the AUM declined year over year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Cohen Steers Inc (CNS) : Free Stock Analysis Report

Eaton Vance Corporation (EV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research