eBay (EBAY) Gears Up for Q4 Earnings: What's in the Cards?

eBay EBAY is set to report fourth-quarter 2020 results on Feb 3. In the last reported quarter, it delivered an earnings surprise of 11.8%.

The company beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, delivering an average of 6.7%.

For the fourth quarter, the Zacks Consensus Estimate for earnings has remained stable at 84 cents per share over the past 30 days. This indicates growth of 3.7% from the year-ago reported figure.

The consensus mark for revenues is pegged at $2.72 billion, implying a decline of 3.6% from the year-ago reported figure.

Let’s see how things have shaped up for this announcement.

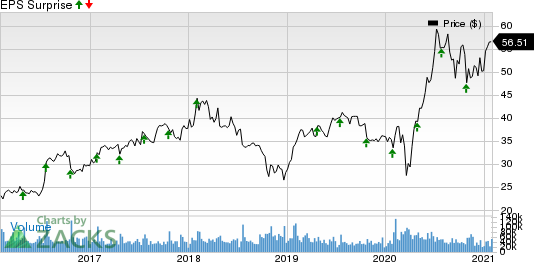

eBay Inc. Price and EPS Surprise

eBay Inc. price-eps-surprise | eBay Inc. Quote

Factors to Note

eBay’s solid performance of the Marketplace platform across all major end markets served is expected to have driven the top line in the to-be-reported quarter.

As revealed during third-quarter 2020 earnings release, growing adoption of the company’s managed payments remained a major positive. The trend is expected to have continued in the quarter to be reported, as the migration of sellers to managed payments increased.

This also bodes well for the company’s growing initiatives toward strengthening the managed payments offerings portfolio and is expected to have helped it in attaining GMV growth. Also, this is in sync with eBay’s deepening focus on scaling managed payments globally.

During the quarter, it rolled out more options of managed payment offerings to France, Italy and Spain. This is expected to have bolstered the Marketplace platform.

Markedly, eBay’s Promoted Listings delivered robust performance in the last reported quarter. This trend is expected to have continued in the to-be-reported quarter, driven by growing momentum across sellers on the back of data-driven recommendations, which in turn are aiding ad conversions.

Its verticals namely Home & Garden, Electronics, Fashion, Auto Parts and Collectibles have been seeing strong demand. The increased demand is being driven by a number of factors like organic traffic, enhanced marketing and higher conversions on its platform.

In addition, eBay’s sales are expected to have improved in the quarter to be reported owing to growth in online consumer spending due to broad-based and increasing social distancing.

Its accelerated Artificial Intelligence efforts through personalization, image search technology and customer support are expected to have enhanced the Marketplace platform.

The company has been providing more data — including price and restocking guidance — to marketplace sellers, as well as greater insight into inventory such as demand signals for the right products, price, and timing.

These factors are expected to have aided the top line in the to-be-reported quarter.

Core Platform Strength to Drive Net Transaction Revenues

In a bid to increase total net transaction revenues, eBay has been strengthening the core platform and improving user experience.

During the third quarter, eBay and Optoro partnered to enable retailers to sell returned and excess inventory easily on eBay, and in turn provide an influx of high-demand wholesale inventory for its sellers. The deal makes reselling on eBay faster, thus accelerating the pace of resale.

The company has been accelerating efforts to build product catalogs on structured data, enhance mobile platform, roll out browse-inspired shopping journeys, rejuvenate customer-to-customer business and strengthen its brand. These are likely to have contributed to top-line growth in the fourth quarter.

Quarterly Expectations

For fourth-quarter 2020, eBay expects net revenues within $2.64-$2.71 billion. The Zacks Consensus Estimate for the same is pegged at $2.72 billion.

Non-GAAP earnings are anticipated in the range of 78-84 cents per share. Notably, the Zacks Consensus Estimate for the same is pegged at 84 cents per share.

Overhangs

Sluggishness in marketing services is expected to have remained a concern for the company.

Also, heightening competition in the e-commerce market from companies like Amazon and multichannel retailers might have affected its quarterly performance.

eBay's increased investment in overall platform technology and slower growth rate than peers might have hampered earnings.

Earnings Whispers

Our proven model conclusively predicts an earnings beat for eBay this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here as you will see below.

Earnings ESP: The company has an Earnings ESP of +1.52%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, eBay has a Zacks Rank #3.

Stocks That Warrant a Look

Here are a few stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in the quarter to be reported.

Microchip Technology Incorporated MCHP has an Earnings ESP of +1.14% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Trimble Inc. TRMB has an Earnings ESP of +8.83% and a Zacks Rank #3.

Lattice Semiconductor Corporation LSCC has an Earnings ESP of +1.19% and holds a Zacks Rank of 3.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

Trimble Inc. (TRMB) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research