Electronic Arts (EA) Cancels and Delays Upcoming Game Titles

Electronic Arts EA announced that it has shelved the release of a game based on the popular Apex Legends and Titanfall franchises, which was coded as TFL, along with its mobile versioned games of Apex Legends and Battlefield. Along with this, the company has also delayed the release of the highly anticipated Star Wars Jedi: Survivor from March to late April.

Though these games were appreciated by players, EA didn’t consider them a financial hit as these big budget games failed to generate enough profits for the company.

This decision could be a cost-cutting move by the company as it has been struggling to meet desired results in terms of userbase and revenues. However, this could result in a losing opportunity for EA as more people are shifting to mobile games due to their ease of use and cost-effectiveness. Per Spicework, 84% of the respondents played mobile games while 36% played console/handheld games and 30% played on a PC.

The cancellation of games has not just disappointed fans but investors as well, as the share price of EA has declined 14.9% in the past year compared with the Zacks Consumer Discretionary Sector, which fell 19.8% in the same time frame.

Major Headwinds Hurt EA's Top Line

Electronic Arts has been witnessing a disturbed top line recently. It saw a decline of 9% year over year in its net bookings in the third quarter of fiscal 2023, which did not meet the company’s projected growth of 42% for the quarter.

The revenue growth has also been slow as it gained 5% in the above-mentioned quarter compared with the 7% growth in the prior-year quarter.

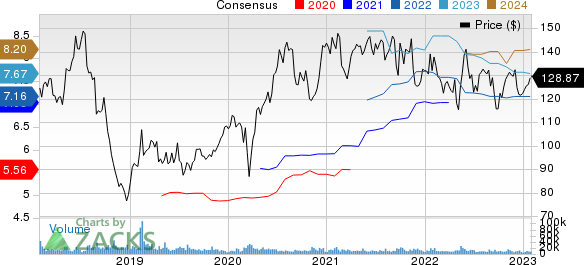

Electronic Arts Inc. Price and Consensus

Electronic Arts Inc. price-consensus-chart | Electronic Arts Inc. Quote

This primarily has been attributed to the macroeconomic headwinds such as rising costs and strengthening of the US dollar that the company suffered in the quarter.

However, on the brighter side, we see that the US Dollar has started to lose its value against major currencies, due to the cooling of inflation and easing of interest rates. This trend is expected to continue in 2023, as per Economic Times, the trend for the US Dollar index remains bearish in 2023 and can be expected to drip down towards 95-94.50 levels from the recent mark of 100. This could boost revenues for EA, as the majority of it comes from international markets.

Plus, EA has been benefiting from EA Sports with EA SPORTS FIFA 23 pacing to be the biggest title in the franchise history, as its net bookings grew 4% year over year in the third quarter of fiscal 2023.

The upcoming EA Sports PGA Tour, a series of golf games, is also expected to add to the growth of the company and improve its top line.

Zack Rank & Stocks to Consider

EA currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the same sector are Manchester United MANU, Stride LRN and BJ’s Wholesale Club BJ, each sporting a Zacks Rank #1 (Strong Buy).

Shares of Manchester United have gained 64.4% in the past year. The Zacks Consensus Estimate for earnings is pegged at a loss of 1 cent, which has been constant over the past 30 days.

Shares of Stride have gained 19.4% in the past year. Its earnings are estimated at $1.08 per share, which increased by 13.6% over the past 30 days.

Shares of BJ’s Wholesale Club have increased 22.2% in the past year. Its earnings are estimated at 84 cents per share, which has been constant over the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

Manchester United Ltd. (MANU) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report