Do Element Fleet Management's (TSE:EFN) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Element Fleet Management (TSE:EFN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Element Fleet Management with the means to add long-term value to shareholders.

View our latest analysis for Element Fleet Management

Element Fleet Management's Improving Profits

Over the last three years, Element Fleet Management has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Element Fleet Management's EPS shot up from CA$0.67 to CA$0.89; a result that's bound to keep shareholders happy. That's a fantastic gain of 34%.

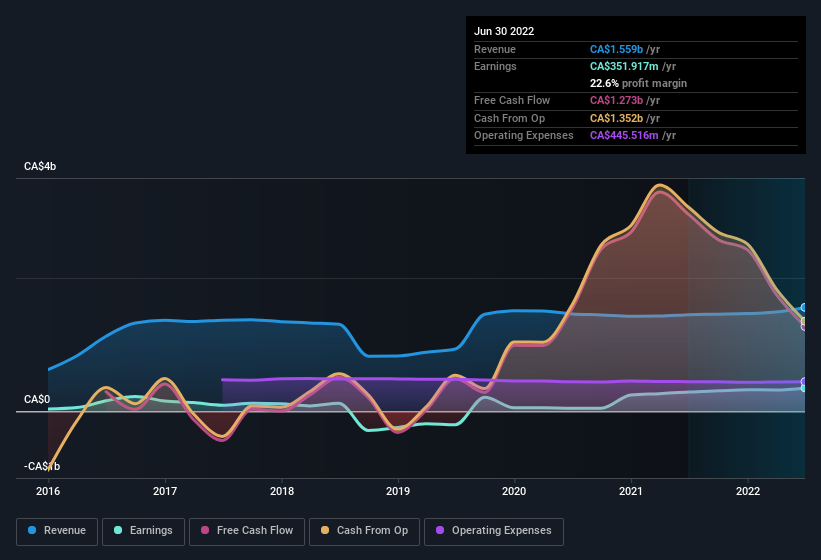

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Element Fleet Management's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Element Fleet Management maintained stable EBIT margins over the last year, all while growing revenue 7.6% to CA$1.6b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Element Fleet Management's forecast profits?

Are Element Fleet Management Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Element Fleet Management shares, in the last year. Add in the fact that Frank Ruperto, the Executive VP & CFO of the company, paid CA$61k for shares at around CA$12.12 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Element Fleet Management.

Does Element Fleet Management Deserve A Spot On Your Watchlist?

You can't deny that Element Fleet Management has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; Element Fleet Management is a strong candidate for your watchlist. Even so, be aware that Element Fleet Management is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Element Fleet Management is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here