Element Solutions Closes Kester Buyout, Reprices Term Loans

Element Solutions Inc ESI announced that it completed the acquisition of Kester from Illinois Tool Works Inc ITW for roughly $68 million in cash.

Per management, the Kester acquisition will add capabilities and scale to its existing electronics assembly materials business. The acquisition serves as a model for highly-strategic acquisitions that the company plans to undertake in addition to the judicious return of capital to shareholders in its capital allocation strategy.

Element Solutions will not witness any substantial increase in its net debt to adjusted EBITDA ratio due to the purchase.

Further, the company announced the repricing of its existing $744-million term loan B, which is expected to reduce borrowing costs by 25 basis points or annual interest expenses by $2 million.

Notably, Element Solutions’ earlier-announced cross-currency swaps and interest rate swaps will still be applicable with the same terms and conditions. Thus, it will effectively set the term loan interest rate at roughly 2% on the Euro equivalent balance of the loans through January 2024. The term loans’ maturity of January 2026 remained unchanged.

The company expects the cumulative impact of the Kester acquisition and the repricing of existing term loans to contribute 3-4% accretion to its adjusted earnings per share (EPS) in 2020.

Shares of Element Solutions have lost 7.3% in the past year against its industry’s 3.9% growth.

In the last month, the company had expected adjusted EPS of 84-87 cents per share for 2019, up from 83-86 cents stated earlier. It reaffirmed adjusted EBITDA growth outlook of 2-5% on a constant currency basis.

Moreover, it expects a 4% organic net sales decline for 2019 compared with a decrease of 1-3% stated previously.

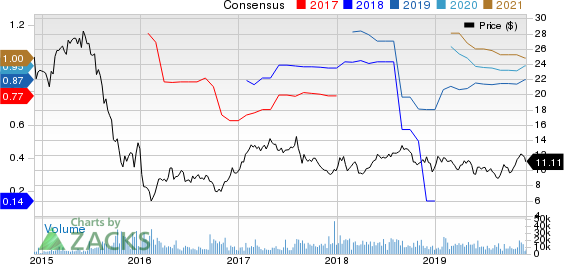

Element Solutions Inc Price and Consensus

Element Solutions Inc price-consensus-chart | Element Solutions Inc Quote

Zacks Rank & Other Stocks to Consider

Element Solutions currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Impala Platinum Holdings Ltd. IMPUY, currently sporting a Zacks Rank #1 (Strong Buy), and Franco-Nevada Corporation FNV, carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Impala Platinum has a projected earnings growth rate of 255.2% for 2019. The company’s shares have rallied 246.4% in a year.

Franco-Nevada has a projected earnings growth rate of 46.2% for 2019. The company’s shares have rallied 42.8% in a year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Element Solutions Inc (ESI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research