Element Solutions (ESI) Up 32% in 6 Months: What's Driving It?

Element Solutions Inc.'s ESI shares have shot up 31.8% over the past six months, outperforming its industry’s rise of 2.4%. The company has also topped the S&P 500’s 14.9% growth over the same period.

Image Source: Zacks Investment Research

Let’s dive into the factors behind this Zacks Rank #2 (Buy) stock’s price surge.

What’s Driving The Stock?

Strong first-quarter results and upbeat prospects have contributed to the company’s shares price increase. Its adjusted earnings of 37 cents per share in the first quarter beat the Zacks Consensus Estimate of 32 cents. It generated net sales of $550.1 million, up around 22% year over year.

The company also announced an increase in its guidance for 2021. It raised its adjusted earnings guidance to at least $1.30 per share, up from the prior view of $1.10-$1.15. It now expects adjusted EBITDA in a band of $500-$510 million. Moreover, it anticipates generating a free cash flow of $285 million for 2021, up from $275 million expected earlier.

Element Solutions is benefiting from healthy demand in its high-end electronics business. It saw strong demand in the broader electronics supply chain and accelerated demand across the industrial economy in the first quarter.

It is also poised to expand from its strategic acquisitions. The recent acquisition of H.K. Wentworth is expected to augment growth in its electronics portfolio. The Kester acquisition has also added capabilities and scale to its existing electronics assembly materials business. Moreover, the DMP buyout has expanded Element Solutions’ investment in technology to offer innovative solutions. The cash proceeds from the divestment of its Agricultural Solution Unit also enable the company to invest in strategic markets and pursue mergers and acquisitions.

Additionally, the company stands to gain from cost discipline, corporate reorganization, procurement and supply-chain saving initiatives in 2021.

The company also remains committed to boosting shareholders' returns. It generated $24 million of free cash flow in the first quarter of 2021. The company continues to look for opportunities to deploy excess capital.

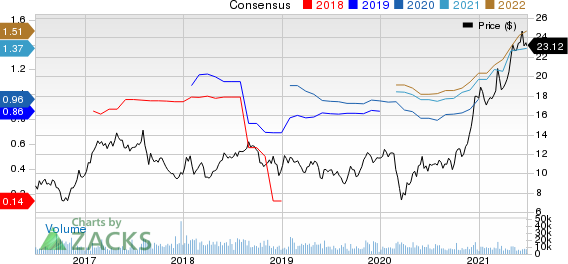

Earnings estimates for Element Solutions have also been going up over the past three months. The Zacks Consensus Estimate for 2021 earnings has increased 15.1%. The consensus mark for 2022 earnings has also increased around 18% over the same time frame. The favorable estimate revisions instill investors’ confidence in the stock.

Element Solutions Inc. Price and Consensus

Element Solutions Inc. price-consensus-chart | Element Solutions Inc. Quote

Other Stocks to Consider

Other top-ranked stocks in the basic materials space are Cabot Corporation CBT, Avient Corporation AVNT and Ferro Corporation FOE, each holding a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot has a projected earnings growth rate of 125.9% for the current year. The company’s shares have risen 53.2% in a year.

Avient has a projected earnings growth rate of 64.1% for the current year. The company’s shares have jumped 86.7% in a year.

Ferro has a projected earnings growth rate of 54.3% for the current year. The company’s shares have grown 79.7% in a year.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Ferro Corporation (FOE) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research