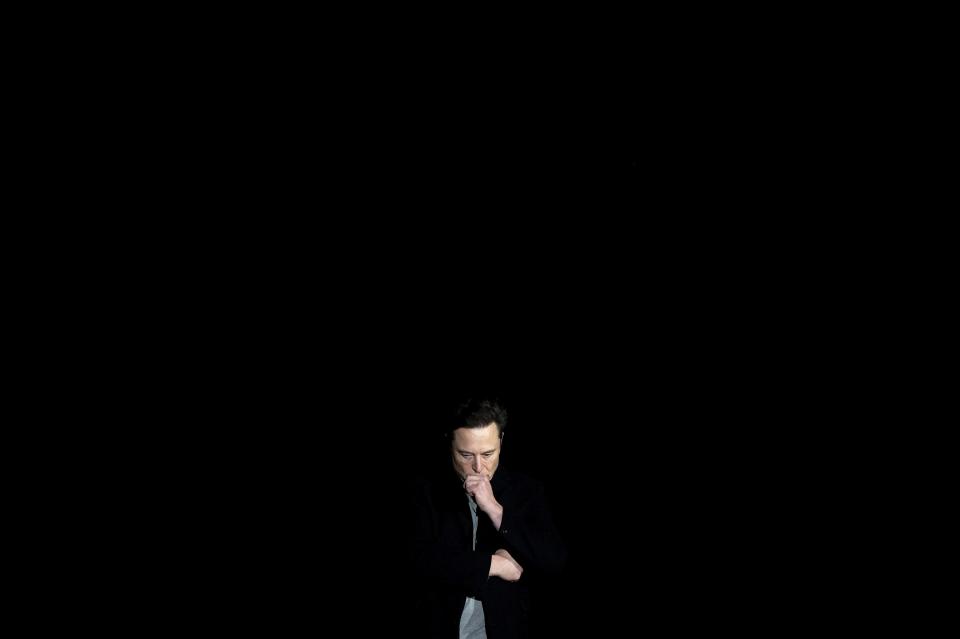

Elon Musk has lost $49 billion since first offering to buy Twitter for $44 billion

While Elon Musk was busy on Wednesday, announcing changes to his political leaning and thrashing “wactivists” on Twitter, the share price of Tesla sank to its lowest level of the year, wiping $12.3 billion from his net worth.

After Wednesday's 6% drop, Tesla shares are now down 28% since Musk launched his bid to buy Twitter on Apr. 14. This means that the vocal Musk's net worth has sunk by $49 billion since he first made his $44 billion offer.

The fall in Tesla stock came alongside a wider market tumble, which saw the S&P 500 drop 4% over the course of the day. But the electric vehicle maker also faced its own unique headwind Wednesday, as it was excluded from the S&P sustainability ESG index due in part to claims of racial discrimination and poor working conditions at Tesla’s California factory.

Musk took to Twitter saying "ESG is a scam," adding that S&P had "lost their credibility" and he would be switching his political support from Democrat to Republican.

https://twitter.com/elonmusk/status/1526997132858822658

Still the richest man

Musk still remains the world’s richest person, according to the Bloomberg Billionaires Index. His current fortune is estimated to be $210 billion—equivalent to 1% of the GDP of the U.S. and 3 million times greater than the median U.S. household income.

But Elon Musk’s net worth has fallen a lot from the $340 billion peak he reached in November 2021. Since the start of the year, Musk has seen his wealth trimmed by 22.4%, or $60.4 billion, trailing behind only Binance CEO Changpeng Zhao, who’s down $81 billion year-to-date, and Jeff Bezos, who has lost $62 billion this year.

Musk’s wealth began to fall precipitously after he first bought a 10% stake in Twitter on Apr. 4. By the time he made a formal offer to buy Twitter on Apr. 14, Tesla shares had fallen by 14%. On the day Twitter accepted Musk's offer of a buyout, shares in Tesla slid another 12%, as market watchers feared Musk wouldn’t have enough cash sitting around to fund the Twitter purchase and would sell Tesla shares to fund the project (he did sell $8.5 billion worth).

The recent slide in Tesla's share price has erased a substantial part of the gains the company made during the pandemic, which saw its market cap rise from $117 billion in January 2020 to $1 trillion in October 2021. Tesla’s market capitalization currently sits at $735 billion.

And as Elon Musk's fortune slides along with Tesla's shares, the company he is trying to acquire has also sunk in valuation. Twitter stock is trading 36% below Musk’s $54.20 offer price, at $36.85 a share.

Hump day tumble

In his latest Twitter outburst, Elon Musk raged about Tesla's expulsion from the S&P ESG index while ExxonMobil, one of the biggest contributors to global greenhouse gas emissions in the world, was kept in.

“ESG is a scam. It has been weaponized by phony social justice warriors,” Musk said. He then posted a meme saying the sustainability criteria put in place by S&P have to do with "how compliant your business is with the leftist agenda”

https://twitter.com/elonmusk/status/1526958110023245829

Elon Musk then announced he would be voting Republican.

Musk has become somewhat of a conservative hero since he announced his plan to buy Twitter and make it into a free-speech platform like a “digital town square.”

Many conservatives have said his buyout would eliminate the biases that social media giants have against them, and right-wing Twitter accounts saw large increases in follower counts on the day the buyout was announced.

Musk has previously criticized President Joe Biden’s administration, saying that it “doesn’t get a lot done,” and has also attacked Democratic lawmakers, including Senate Finance Chairman Ron Wyden, Sen. Elizabeth Warren, and Rep. Alexandra Ocasio-Cortez, all of whom have advocated higher taxes on billionaires. He has also said that it was “flat out stupid” for the platform to ban Trump after the Jan. 6 U.S. Capitol raid.

This story was originally featured on Fortune.com